Founder Fridays No. 84

Q1 Venture Funding Data -- 1,000 Profitable Niches -- Breaking the Micromanagement Habit

Happy Friday.

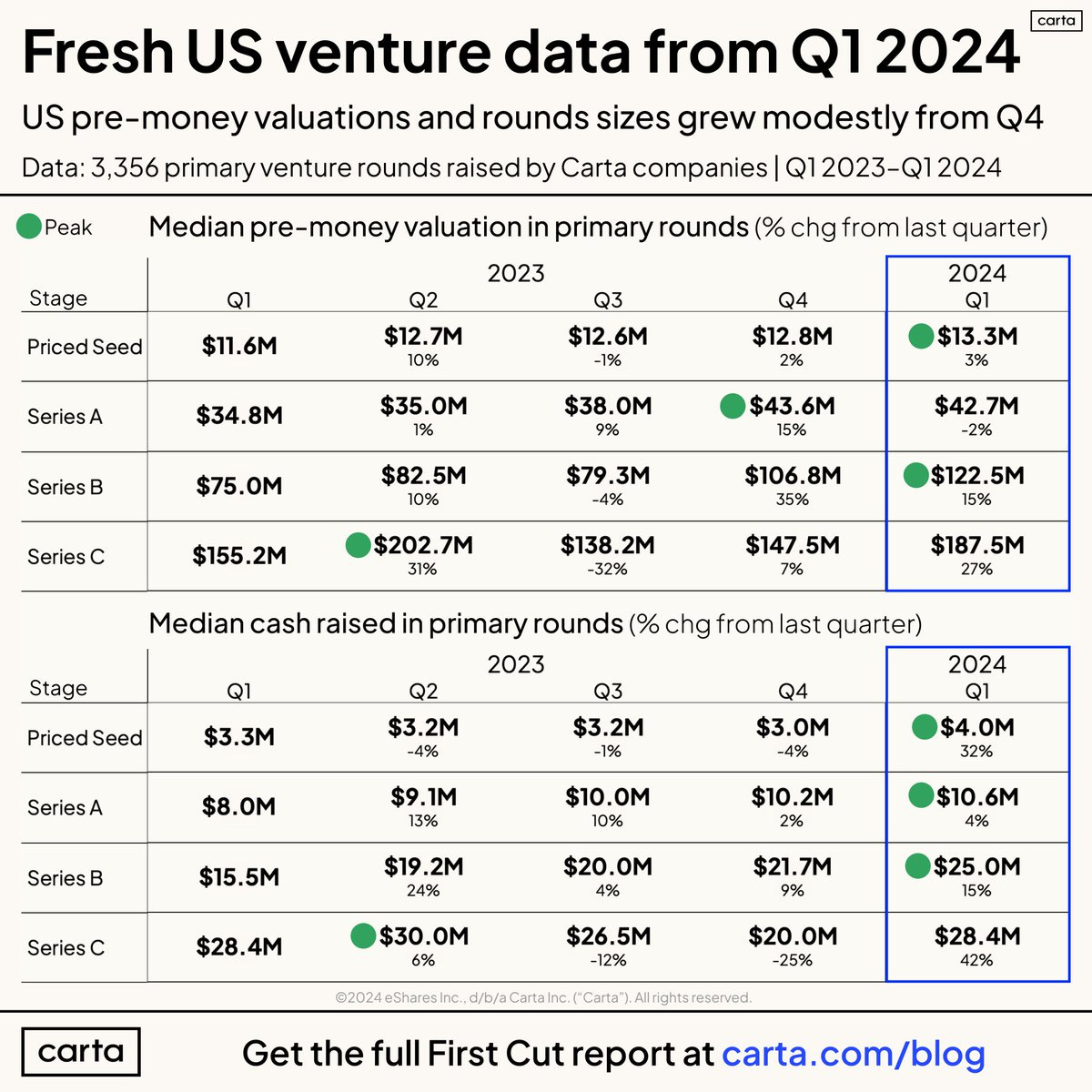

Q1 Venture Funding Data

Carta just released the first cut of their Q1 2024 US venture funding data. Our monthly venture funding reports are based on AngelList’s data, and you’ll see that there’s some delta between the two data sets. The headlines are 1) Valuations rose—but not for late-stage: Median pre-money valuations ticked upwards for most venture stages, but declined (albeit on low round volume) for Series D and E+. 2) Round sizes grew: The median amount of cash raised was up for seed, Series A, Series B, and Series C, with particularly sharp increases in the priced seed and Series C stages. Although the final numbers on total rounds and capital raised are not yet available for Q1, it looks like another quarter of modest growth for venture capital activity is likely. See the chart below for more details. Carta (3 minutes)

1,000,000 Profitable Niches

In his 2008 essay "1,000 True Fans," Kevin Kelly, the founding executive editor of Wired, predicted that the internet would transform the economics of creative activities. However, the reality today suggests that closer to 1 million true fans may be needed due to big-tech-owned social media platforms taking a substantial share of revenue from creators. While the internet offers vast opportunities for creators to reach a global audience and connect with fans, critics and collaborators, it often requires them to rely on corporate networks that absorb significant financial resources. The current state of affairs should be improved to make the internet a catalyst for human creativity and authenticity rather than an inhibitor. Blockchain networks can enable a market structure with millions of profitable niches, leading to fairer revenue distribution. This shift would allow more users to find their true callings and enable creators to connect with their genuine fan base, ultimately promoting a more diverse and vibrant creative landscape. Tim Ferriss (6 minutes)

Breaking the Micromanagement Habit

To break the cycle of micromanagement and foster a healthy work culture, consider three key strategies: 1) Define Clear Expectations: Start by communicating explicit goals, roles and responsibilities to avoid ambiguity. Clarity from the beginning ensures everyone is on the same page and reduces the need for constant supervision. For example, provide specific deadlines instead of vague timeframes. 2) Provide Autonomy: Empower your team members to handle tasks in their own efficient way. This autonomy boosts their morale and sense of responsibility, transforming them from mere workers into responsible partners. Avoid policies that overly control employees' work hours and focus more on assessing results rather than monitoring the process. 3) Be Self-Aware and Let Go: Recognize your own micromanagement tendencies and their negative impact on the work culture. Embrace delegation, resist the urge to micromanage outside of regular progress checks and release the pressure to be involved in every detail. Assign tasks based on team members' strengths; offer support, coaching and guidance; and allow them to navigate challenges independently. Implementing these strategies can help break the micromanagement cycle and promote a more productive and positive work environment built on trust and autonomy. Forbes (5 minutes)

Founder FAQ: What should be included in the initial board consent?

The initial startup board consent is an important document that outlines the roles and responsibilities of the board of directors in the early stages of a company’s formation. This document guides decision-making processes, sets expectations for board members and establishes accountability measures. The purpose of this consent is to ensure that all parties involved are aligned with the vision and goals of the company, and are committed to working together to achieve success. It also provides a framework for addressing potential conflicts or issues that may arise down the road. Overall, the initial startup board consent plays a crucial role in laying the foundation for a successful business venture. Westaway (6 minutes)

Startup Funding Guides

I’ve put together a series of guides to equip founders to excel at fundraising. These guides break down the deal term-by-term and give you negotiation tips so that you can speak to investors with confidence.

Convertible Note: Guide / Video

Certainty in an Uncertain World

The startup journey is filled with uncertainty. A fractional General Counsel (GC) provides the certainty of on-call legal expertise. Having an experienced GC gives founders invaluable peace of mind. With a seasoned startup legal expert on demand, founders have a steady guide through uncertain legal terrain. The GC acts as a trusted strategic advisor while also handling day-to-day legal tasks. This lifts a huge burden off startup leaders, allowing them to focus on growth with legal confidence. Rather than getting bogged down in legal details, founders feel empowered delegating to an expert and focusing on their vision. Founders sleep better knowing their GC can swiftly handle any legal issue that arises. If you’re curious how a fractional GC can give you peace of mind, let’s talk.