Founder Fridays No. 45

Helping startup founders scale smarter.

Happy Friday!

It’s the first Friday of the month, so that means it’s funding Friday. The last 12 months have been really brutal for startups trying to raise money. But this month, we’re seeing some good news:

Both the money raised and the valuations for deals done in June were up across the board, from Pre-Seed to Series B.

We’ll need a few more months to understand if this was a fluke, or if this is a sign that the worst is behind us. But, either way, it’s enough to put a smile on the face of founders. ;-)

Seed Valuations

While Series A - C valuations have fallen sharply over the last year, Seed valuations have remained fairly steady. In Q1, seed valuations only fell 4% year over year, compared to 42% for Series A and 51% for Series C. Why is that? 1) Trickledown. The later the stage, the bigger the decline in valuations. Of course, the price reset really starts in the public markets, which then affects later stage private deals. Over time, as C rounds get priced down, this pushes B valuations down as well, and then A — if a typical B valuation goes from $200 million to $100 million, then it stops making sense to value a company at $90 million in the A. So it takes time for pricing trends to reach seed rounds, but they will trickle down eventually. 2) Multi-stage funds that deployed capital too quickly in the bull run now need to respond by reducing the amount of capital they invest. Yet they need to remain active, so they’re shifting their attention from later stage deals to smaller seeds. 3) Third, many seed funds were raised during the bull run of the past few years — frankly, too many, which drove up competition and valuations at the Seed stage. 4) You guessed it…. AI. Because generative AI is so novel, the most exciting opportunities are found with new companies raising seed rounds. But as those companies mature, the opportunities to invest in AI will move into the later stages. Taking these 4 together, this could lead seed valuations to reduce over the next 12 or 18 months. @Hadley (4 minutes)

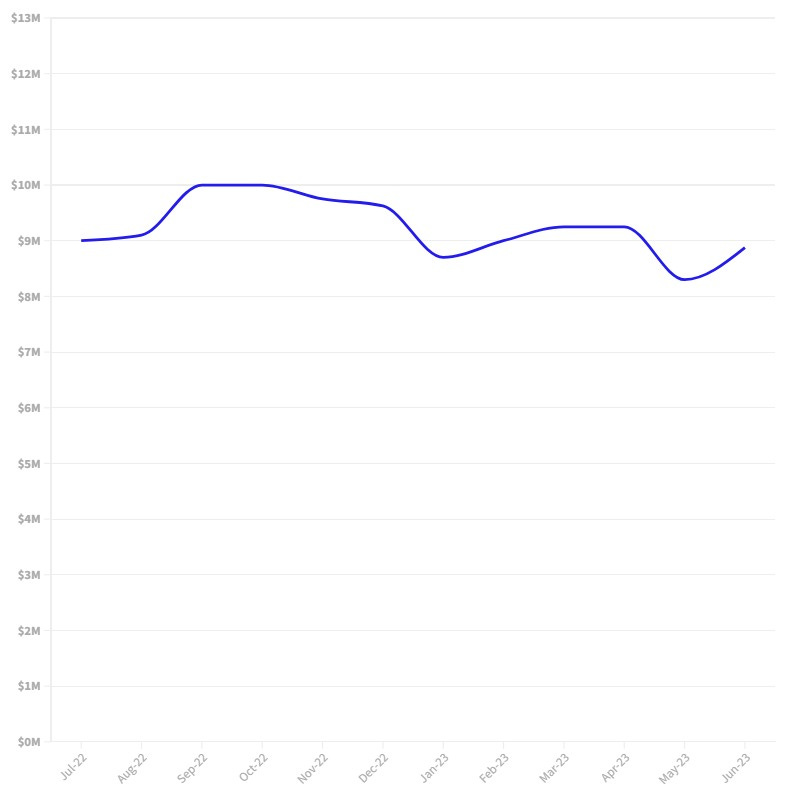

Pre-Seed

Median Money Raised:

$1,020,625

Median Post-Money Valuation:

$8,875,000

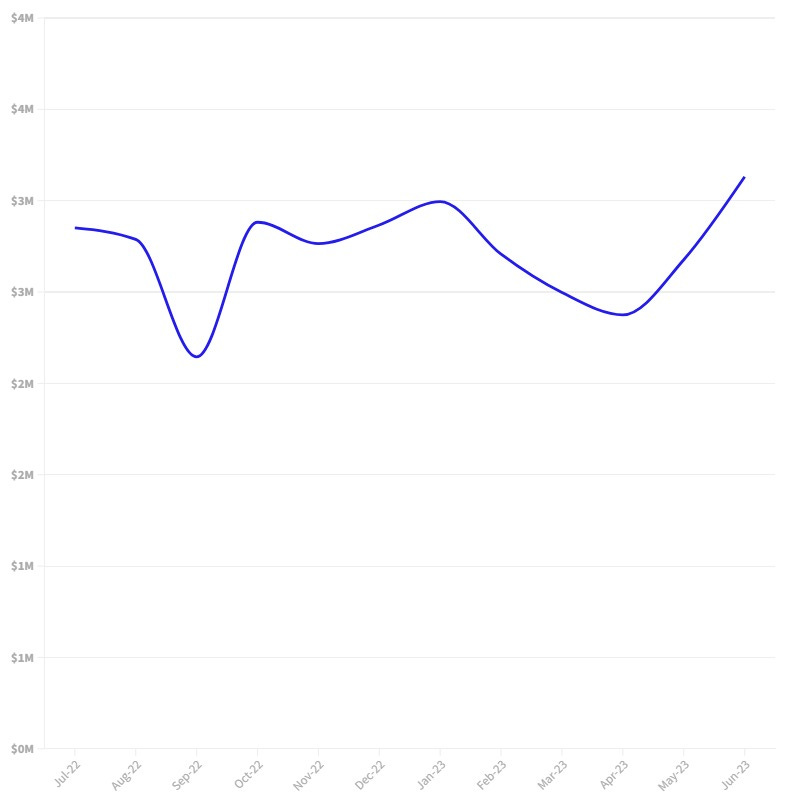

Seed

Median Money Raised:

$3,131,250

Median Post-Money Valuation:

$20,875,000

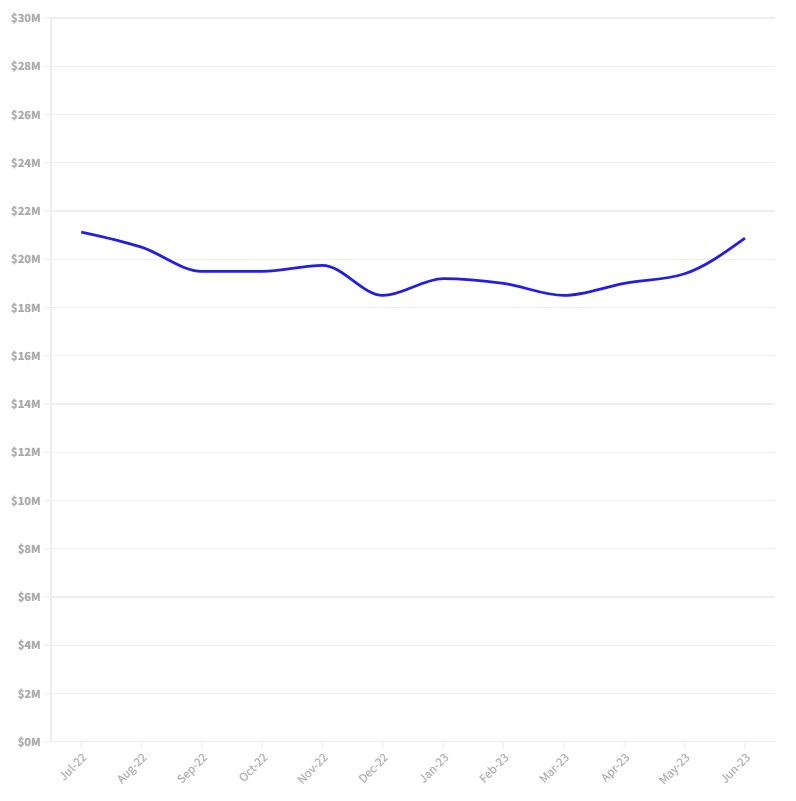

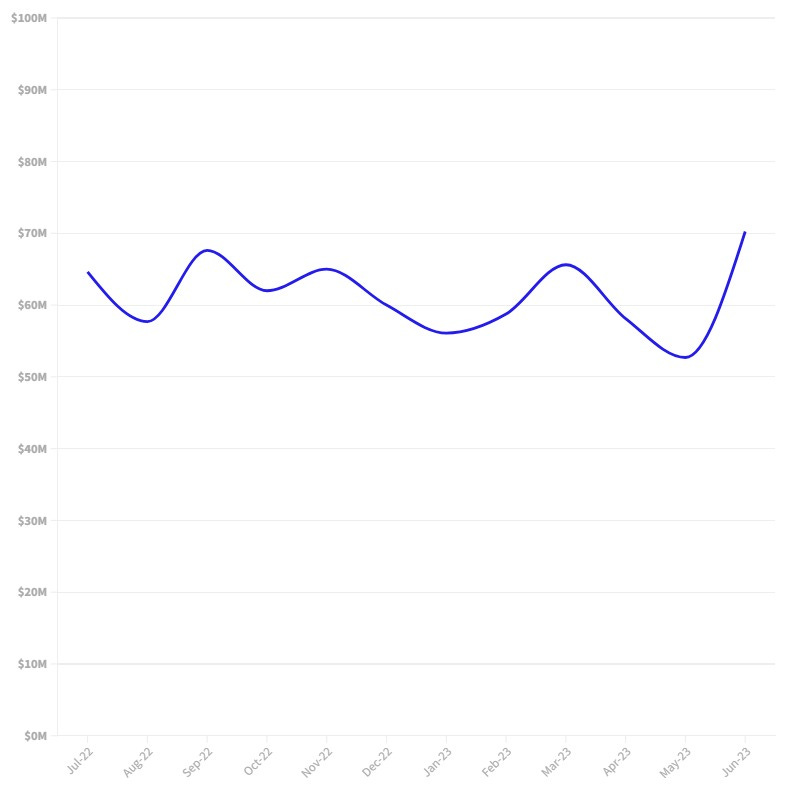

Series A

Median Money Raised:

$12,293,750

Median Post-Money Valuation:

$70,250,000

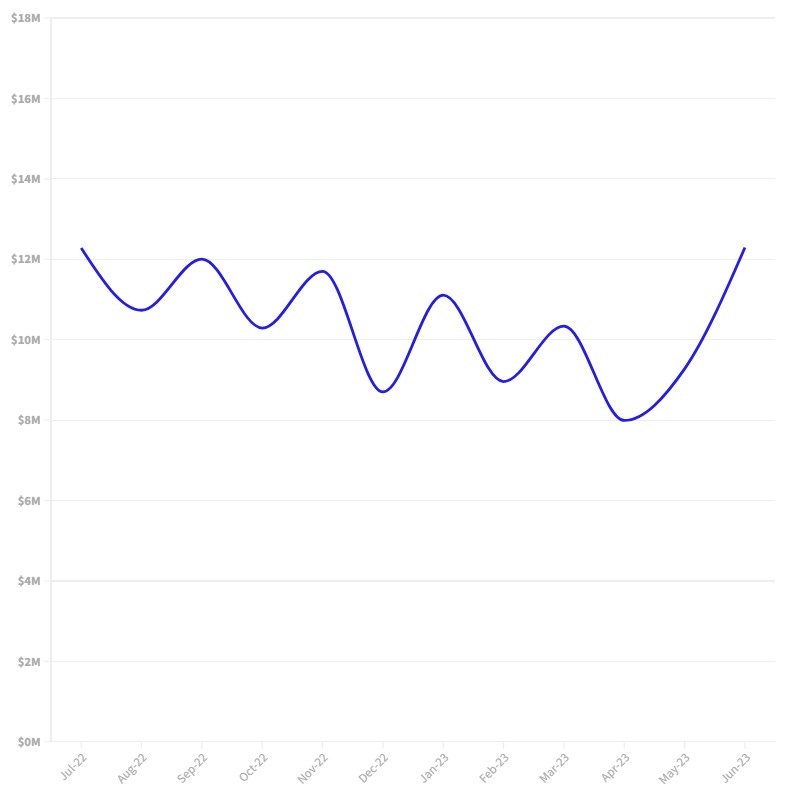

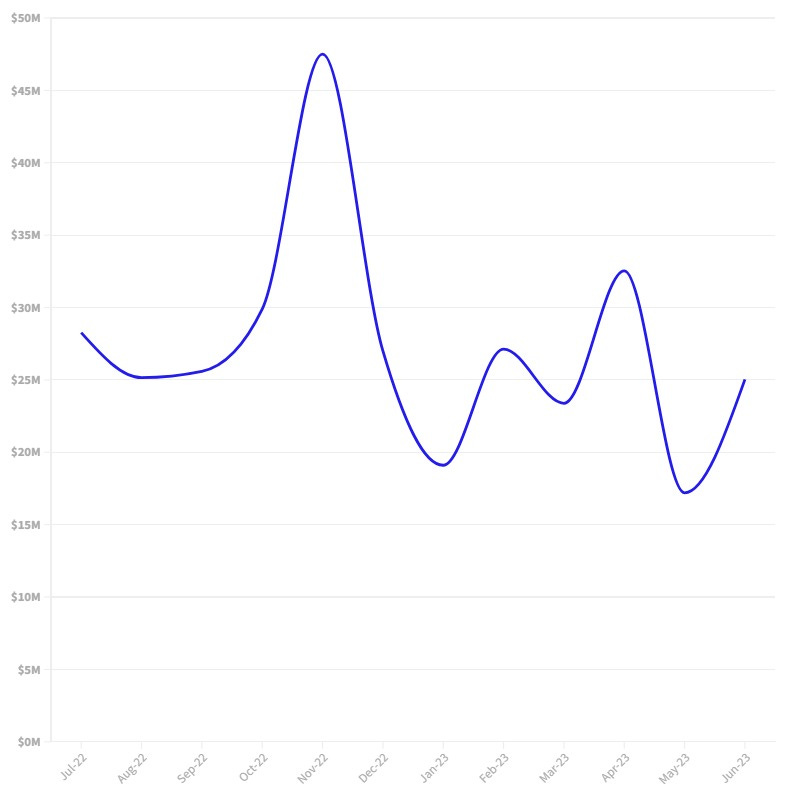

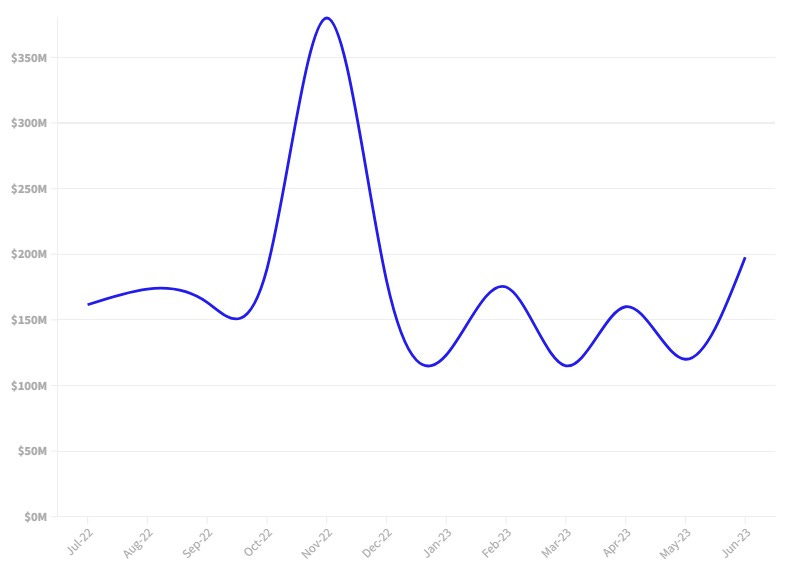

Series B

Median Money Raised:

$25,037,778

Median Post-Money Valuation:

$197,666,667

Startup Funding Guides

I’ve put together a series of guides to equip founders to excel at fundraising. These guides break down the deal term by term and give you negotiation tips so that you can speak to investors with confidence.

Move Fast. Don’t Break Things.

Hi! I’m Kyle. This newsletter is my passion project. When I’m not writing, I run a law firm that helps startups move fast without breaking things. Most founders want a trusted legal partner, but they hate surprise legal bills. At Westaway, we take care of your startup’s legal needs for a flat, monthly fee so you can control your costs and focus on scaling your business. If you’re interested, let’s jump on a call to see if you’re a good fit for the firm. Click here to schedule a 1-on-1 call with me.