Funding Fridays No. 9

Funding Fridays - a briefing on startup funding.

Happy Friday!

As you all know, this email is a new project for me and I continue to iterate in order to make this the best it can be.

The Goal - Empower founders to raise capital smartly by equipping them with general market data.

A New Approach - I am agnostic on how this briefing achieves that goal. I’ve been getting a ton of feedback from you. (Y’all are chocked full of good ideas.) One thing that comes up over and over again is that the data is erratic, which makes it less useful. One reason for that is that the sample size in any given week is small, and therefore not accurately capturing what’s actually going on in the startup funding market broadly.

I’ve put a lot of thought into solving this problem, and I think the best solution is to change from a weekly to a monthly cadence. This is why I think it works better:

Analyzing a month’s worth of deals increases the sample size by 4X, which increases the accuracy and reliability of data output.

The result are smoother and more readable / helpful charts (as you can see below).

Ultimately, I think a monthly cadence strikes a good balance to be frequent enough to be fresh, yet enough a large enough data set to be reliable.

I think this is a good move to achieve the goal. What do you think? Click here to vote yes or no.

If I decide to keep it as a monthly email, then you should expect to see this email in your inbox on the first Friday of every month. Thanks again for all your input. Enjoy the briefing.

Did your brilliant friend forward this to you? Subscribe here.

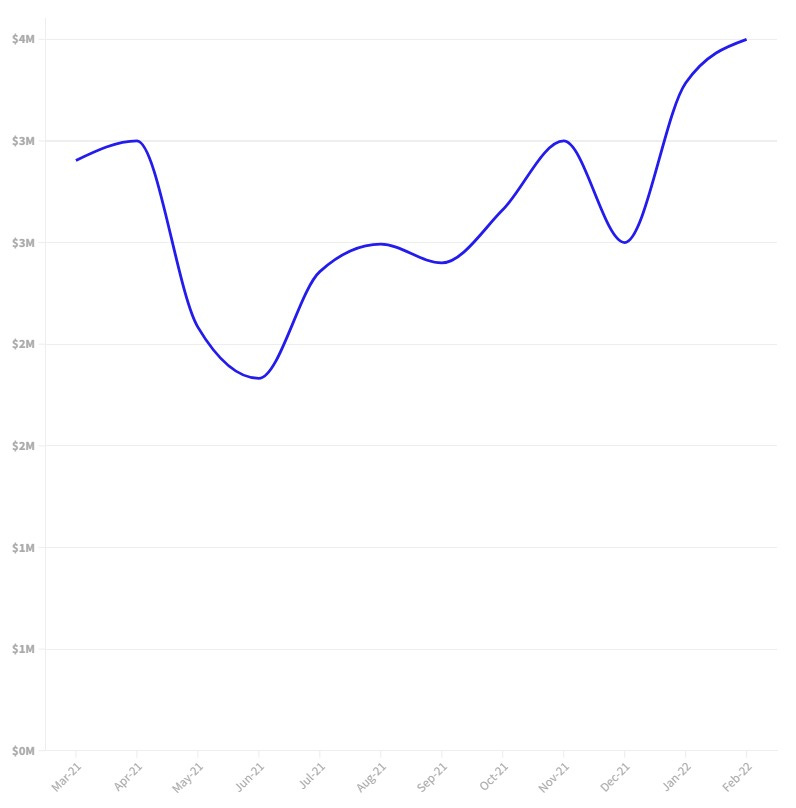

Pre-Seed

Median Money Raised - $543,462

Median Valuation - $3,500,000

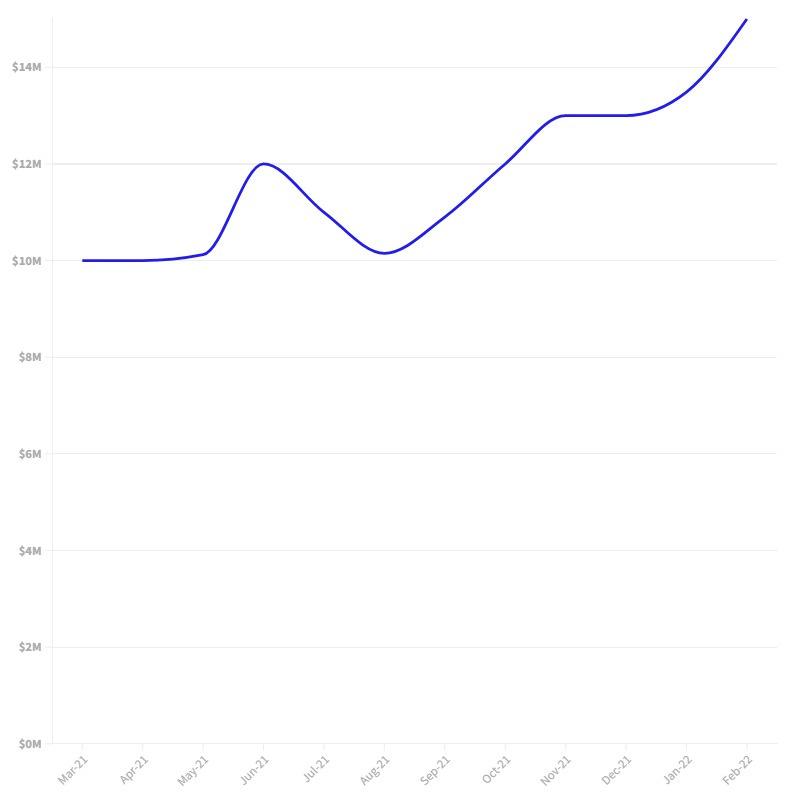

Seed

Median Money Raised - $2,423,764

Median Valuation - $8,150,000

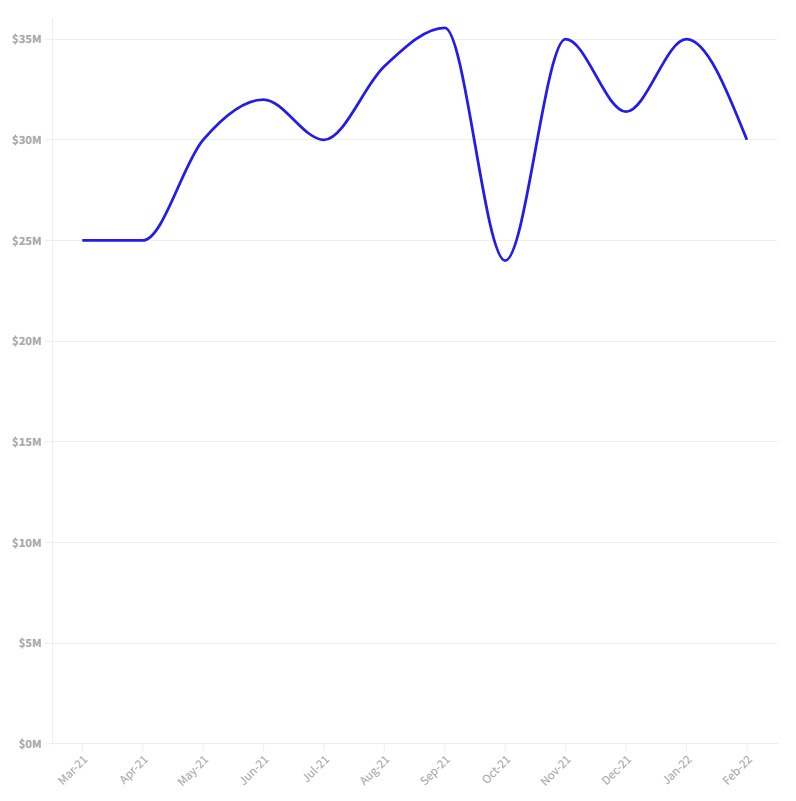

Series A

Median Money Raised - $15,000,000

Median Valuation - $66,000,000

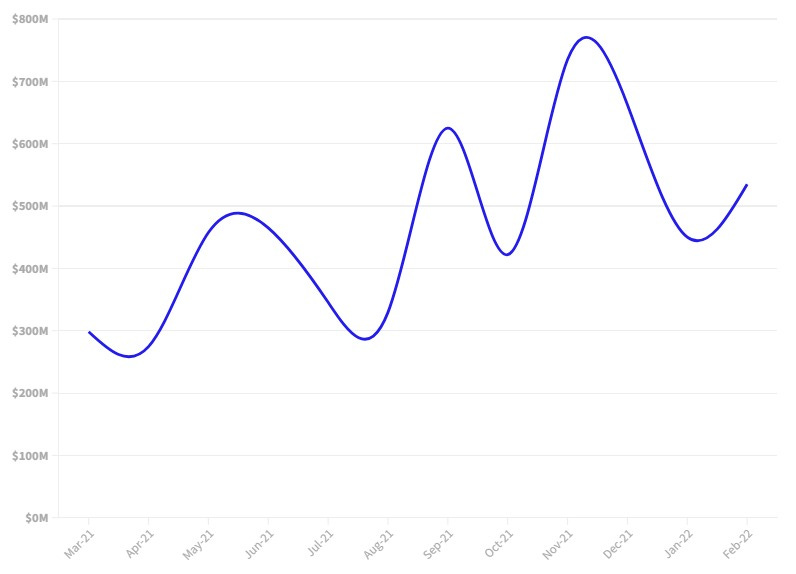

Series B

Median Money Raised - $30,000,000

Median Valuation - $535,000,000

Series C

Median Money Raised - $62,825,909

Median Valuation - $811,155,606

About Funding Fridays

Funding Fridays is a briefing on startup funding written by Kyle Westaway – Managing Partner of Westaway.

Subscribe

Did your brilliant friend send this to you? Subscribe here.