Founder Fridays No. 17

A briefing on startup funding sent out on the first Friday of the month.

Happy Friday! If you’re looking closely, you may notice that the name of the briefing has changed from “Funding Fridays” to “Founder Fridays”. We’ve got some exciting updates happening in the new year that I’m really looking forward to sharing with you. But for now, enjoy the funding data.

The Geography of Funding

Silicon Valley accounted for less than 20% of deal making nationally in the third quarter, marking the steady erosion of the region’s grip on startups and venture capital as companies increasingly spring up throughout the country. In the third quarter of this year, 586 Silicon Valley-based startups raised venture funding rounds, a 40% drop from the same quarter a year ago and the largest decline among the nation’s major technology hubs. One might conclude other geographies have siphoned San Francisco’s dollars. But, to paint one geography’s success as a loss for another is a false dichotomy. Rather, the entire industry is expanding. Wall Street Journal (6 minutes)

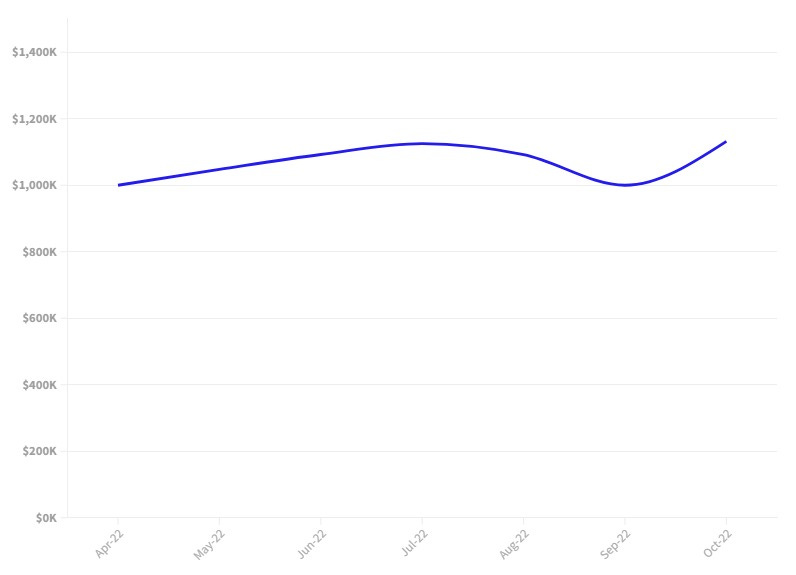

Pre-Seed

Median Money Raised:

$1,132,000

Median Post-Money Valuation:

$10,000,000

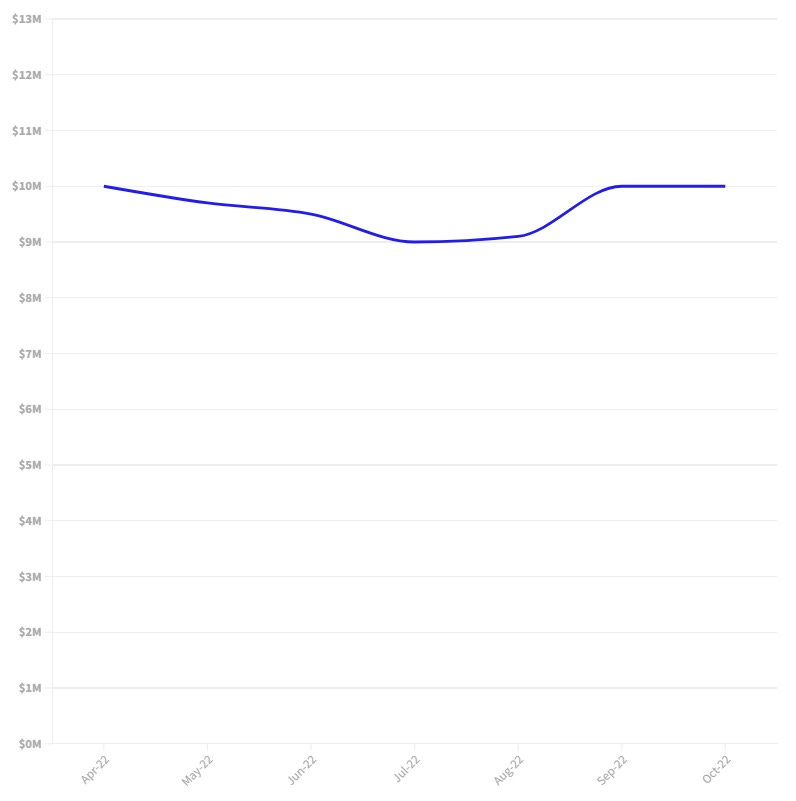

Seed

Median Money Raised:

$2,882,000

Median Post-Money Valuation:

$19,500,000

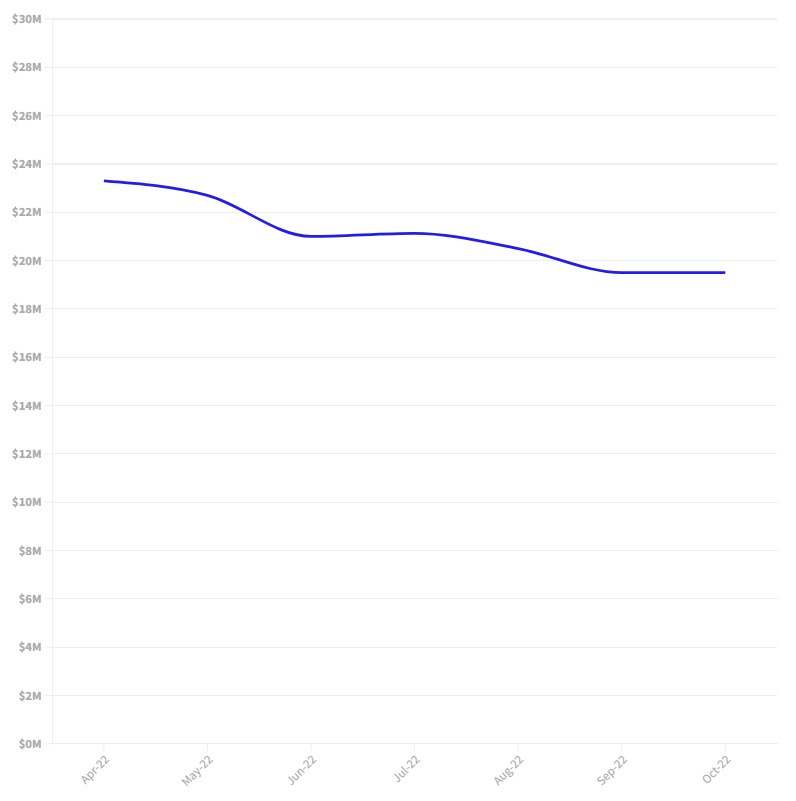

Series A

Median Money Raised:

$10,290,000

Median Post-Money Valuation:

$62,000,000

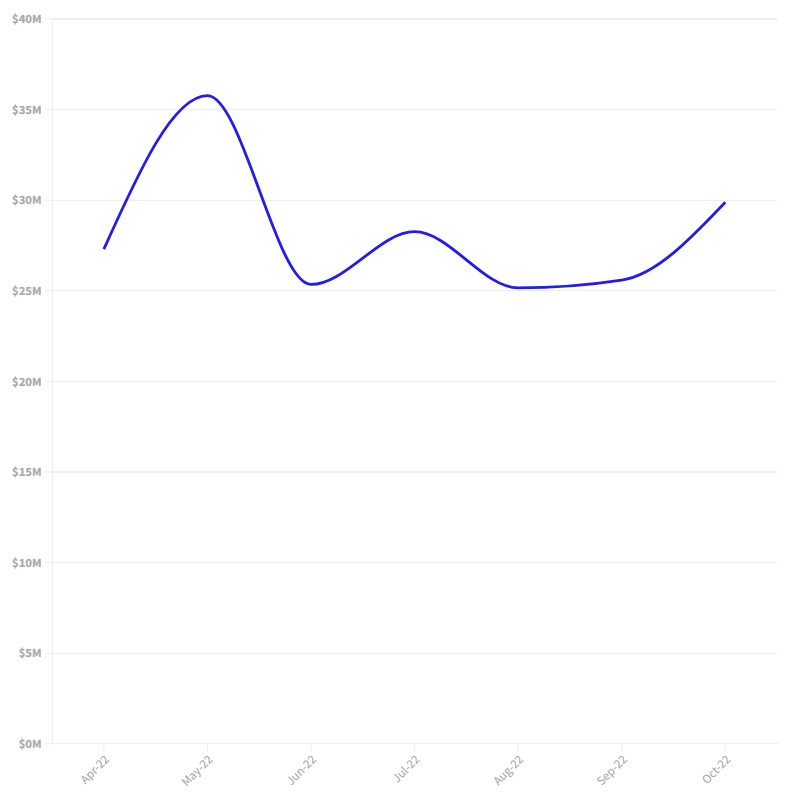

Series B

Median Money Raised:

$29,887,500

Median Post-Money Valuation:

$188,750,000

Series C

Median Money Raised:

$29,400,000

Median Post-Money Valuation:

$210,000,000

About Funding Fridays

Funding Fridays is a briefing on startup funding written by Kyle Westaway – Managing Partner of Westaway and powered by data from AngelList.