Funding Fridays No. 12

Funding Fridays - a briefing on startup funding.

It’s the first Friday of the month, so that means it’s time for Funding Fridays.

As you scroll through the graphs, you’ll note that the data indicates that there has been a downturn in the funding market. (That doesn’t come as a surprise if you’ve been reading all the doom and gloom by VCs and founders on Twitter and blogs.) The data shows a small drop in the median money raised in 2022, but a significant drop in valuations at every stage from Pre-Seed through Series C. So, relative to 2021, founders are getting slightly smaller checks and giving away more of their company in each round.

If you’re a founder and wondering what actions you should take, check out the first story below - Navigating A Downturn.

Did your brilliant friend forward this to you? Subscribe here.

Navigating A Downturn

Every other blog or tweetstorm seems to offer the same general advice for founders to navigate a funding downturn: conserve cash, extend runway, shift from focusing on growth to focusing on efficiency. A16z offers a tangible framework to quantify the magnitude of the change in valuations and what it means for your next round and charting their future course. (1) Revaluate your valuation. You can get a rough estimate for the change in your valuation by looking at leading public companies in your sector. If they’re down 60%, there’s a good chance you’re in a similar position. (2) Control Your Burn Multiples. Now that you have a target ARR, how do you evaluate if your business is growing efficiently to reach it? Here we shift our focus to burn multiples, which we define as cash burned divided by net ARR added. For example, if a company burns $40M to add $10M of ARR, it would have a burn multiple of $40M/$10M, or 4.0x. Burn multiples are a metric you can evaluate every quarter, and tracking it closely can ensure you stay on plan. (3) Scenario planning is helpful for considering how macro events – wars, supply chain issues, inflation – could impact performance metrics, like growth and CAC. Keeping a close eye on cash outlay and having scenario plans will enable you to quickly adjust spending and investment in response to performance. At a minimum, we recommend planning for the following three scenarios: a) Base Case: 80% confidence plan that you know you can hit with good burn multiple efficiency. b) Best case: ARR growth and burn rate is likely at or better than your operating plan from six months ago. c) Worst case: You need to slow burn significantly and lengthen your runway. Future (12 minutes)

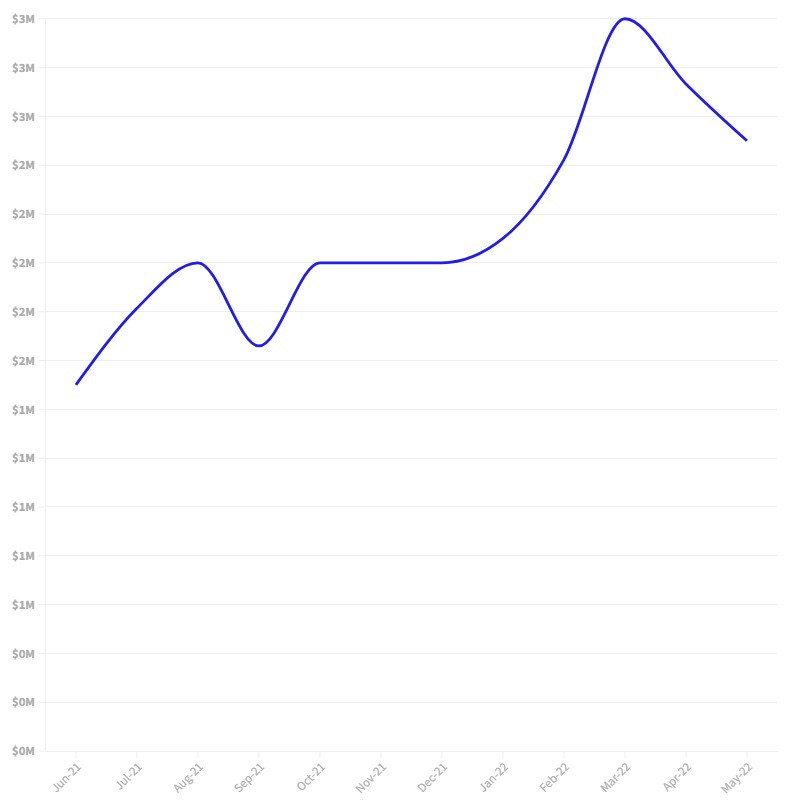

Pre-Seed

Median Money Raised - $500,000

Median Valuation - $2,617,903

Seed

Median Money Raised - $2,500,000

Median Valuation - $6,510,570

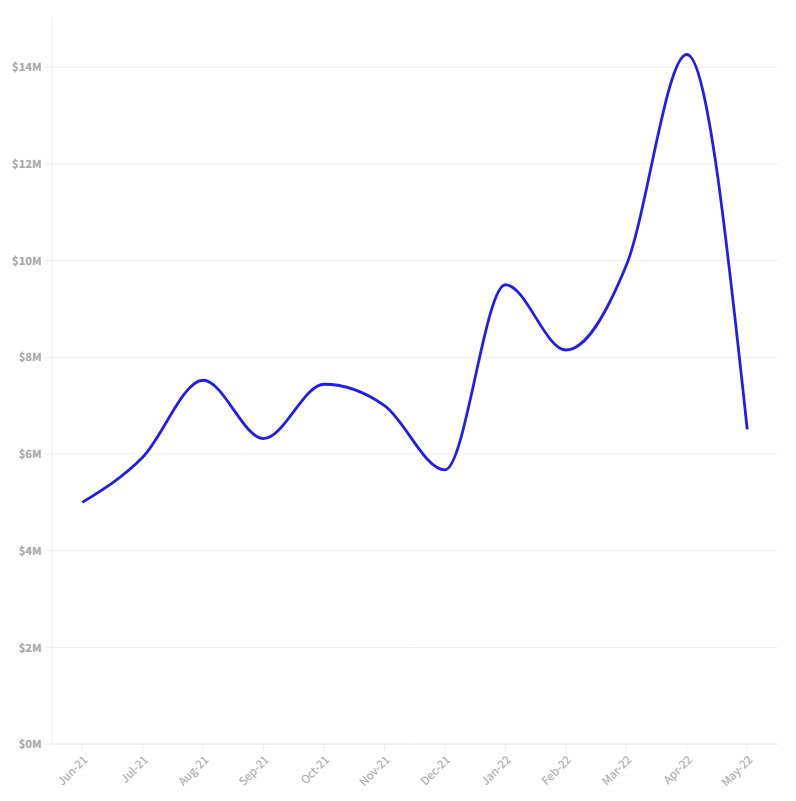

Series A

Median Money Raised - $12,000,000

Median Valuation - $54,499,852

Series B

Median Money Raised - $30,000,000

Median Valuation - $390,000,000

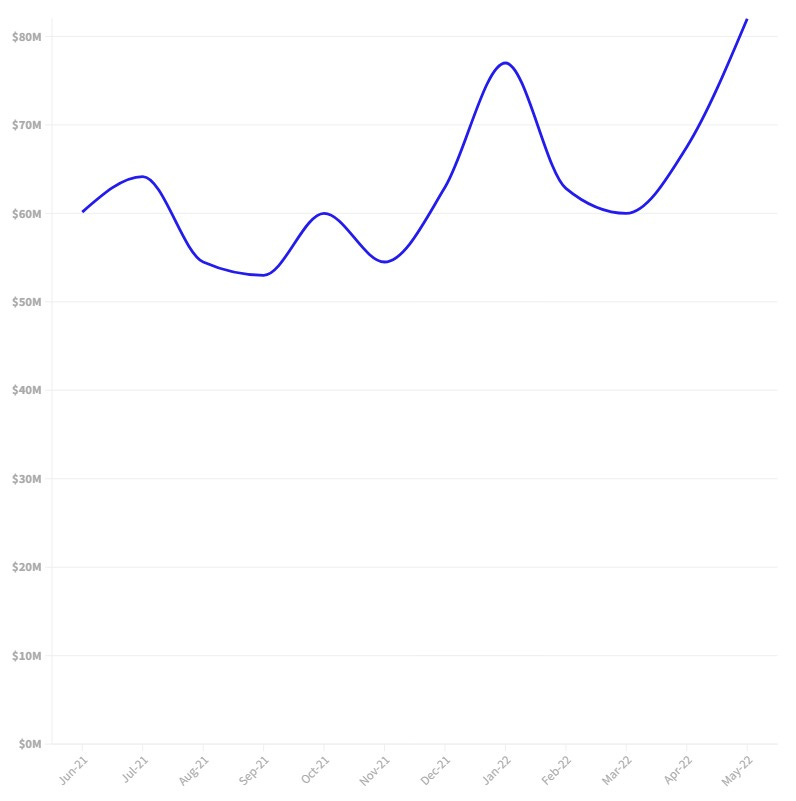

Series C

Median Money Raised - $82,000,000

Median Valuation - $970,000,000

About Funding Fridays

Funding Fridays is a briefing on startup funding written by Kyle Westaway – Managing Partner of Westaway. Photo by Annie Spratt.

Subscribe

Did your brilliant friend send this to you? Subscribe here.