Founder Fridays No.68

SAFE Valuation Caps Are All Over The Place.

Happy Friday.

SAFE Valuation Caps

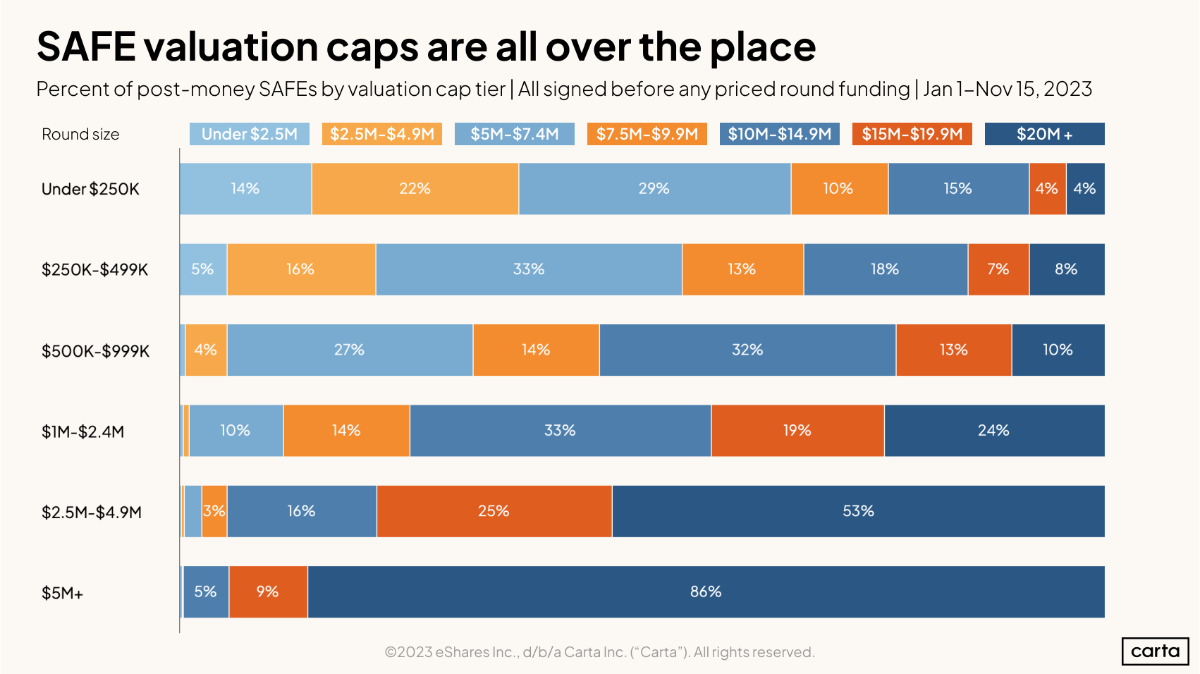

One of the most common questions I get form early-stage founders is: What should the valuation cap be on my upcoming SAFE fundraise? It’s hard to figure out! You’ve got angels in smaller markets insisting that anything above a $3 million valuation cap is silly in today’s market. You’ve got YC founders raising on $20 million valuation caps as a matter of course. Fortunately, Carta has some data. SAFE rounds that raise under $250K have a median valuation cap of $5 million, with a healthy amount both above and below that figure. Personally, a little apprehensive about the really large val caps at a small cash raise. $250K-$500K? The median is a $6 million valuation cap. $500K-$1 million? This is a big bump up to a $10 million median cap. Beyond $1 million, I’d say you’re getting into “seed on SAFEs” territory (although I’ve heard that pre-seed may now extend up to $2 million raised). In any case, the clear takeaway here is that there is no “right” answer. People tend to default to round numbers at this stage. See the graph below. Carta (2 minutes)

Mo’ Founders, Mo’ Problems

Co-founders — can’t live with them, can’t (usually) build mega-successful companies without them. No matter how brilliant a startup’s founders are, they are still human and can fall into dysfunctional patterns. While many startups die because they don’t find product-market fit, co-founder drama might be just as big of a cause. Unfortunately, “people problems” are far more difficult to talk about than products. This article discusses how to deal with co-founder drama from a solo-founder to a four-plus founder company. Every (9 minutes)

CEO Time Breakdown

Sam Corcos, CEO of Levels, tracks how he spends his time in 15-minute increments. He was surprised to find that he was spending more than three hours per day on social media and several additional hours consuming news. This prompted him to make some serious changes to how he spends his time. After two years, he’s sharing an unvarnished look at how he actually spent his time. His goal? For folks out there with hopes to become a startup CEO, you can get a behind-the-scenes deep dive into how you might actually spend your time on the path to building a company. First Round Review (17 minutes)

Founder FAQ: How do I avoid trademark infringement when choosing a name for my startup?

If you’re starting a new business, choosing a name for your startup is an important step in establishing your brand identity. However, it’s crucial to ensure that your proposed name doesn’t infringe on existing trademarks to avoid costly legal disputes in the future. In this post, we’ll provide you with tips and best practices for avoiding trademark infringement when choosing a name for your startup. We’ll also cover the importance of choosing a distinctive name, conducting thorough research and registering your trademark. Westaway (7 minutes)

Startup Funding Guides

I’ve put together a series of guides to equip founders to excel at fundraising. These guides break down the deal term-by-term and give you negotiation tips so that you can speak to investors with confidence.

Convertible Note: Guide / Video

An Innovative Law Firm?

Being listed among Fast Company's “Most Innovative Companies” is an honor for our law firm, yet we believe innovation matters if it actually produces better outcomes for startups. Here’s how we’ve innovated to better serve startups:

Clear Pricing. Traditional billable hours can lead to misaligned objectives and unexpected fees. We've replaced this with straightforward, flat-rate pricing.

General Counsel. Most entrepreneurs want a trusted legal partner, but they hate surprise legal bills. At Westaway, we take care of your startup’s legal needs for a fixed, monthly fee so you can control your costs and focus on scaling your business.

Automation and AI. We've streamlined our operations through automation and AI (where appropriate), ensuring efficient, high-caliber results.

If you’re an innovative startup looking for an innovative law firm, let’s talk.