Founder Fridays No. 79

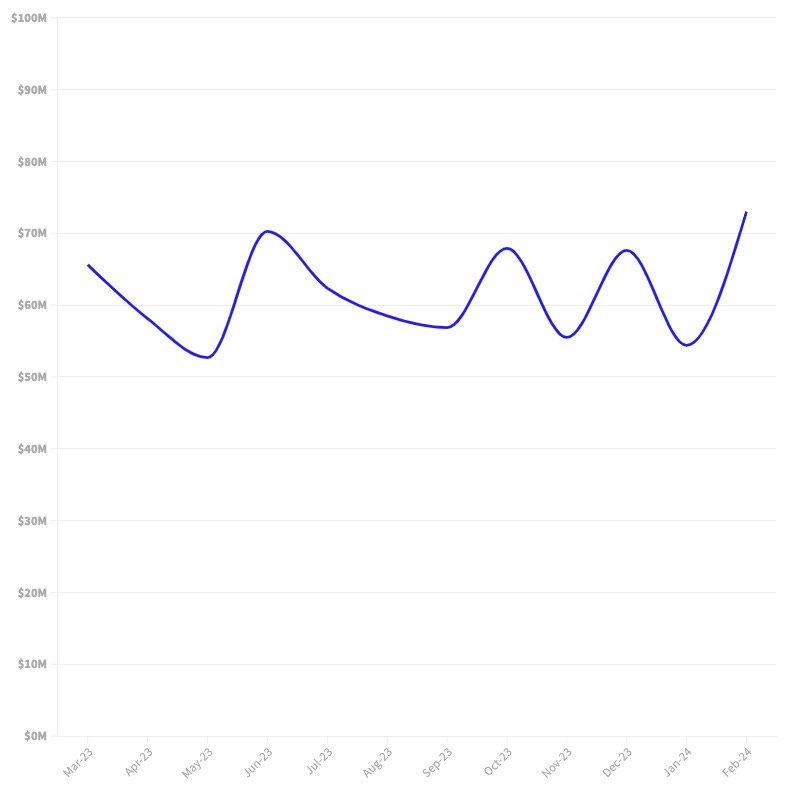

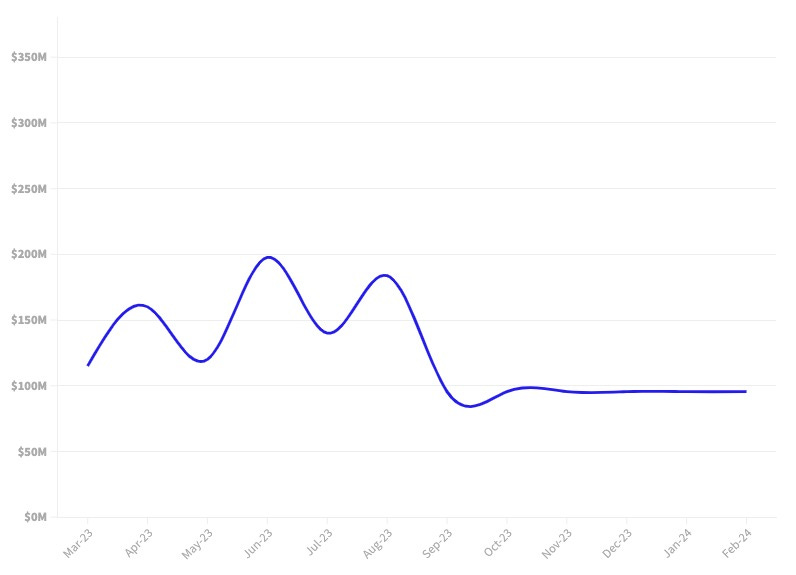

Delaware Franchise Tax Freakout -- February Startup Funding Data

Happy Friday.

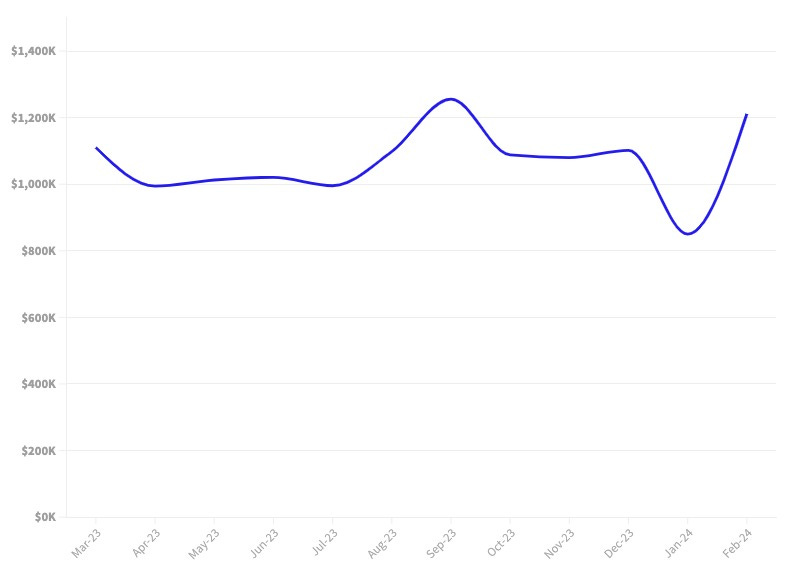

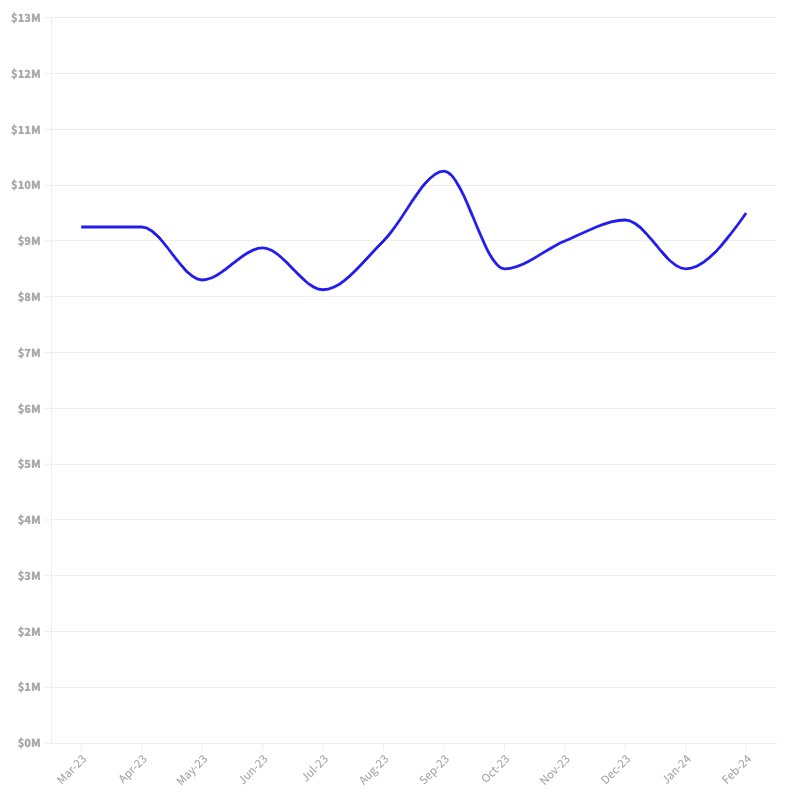

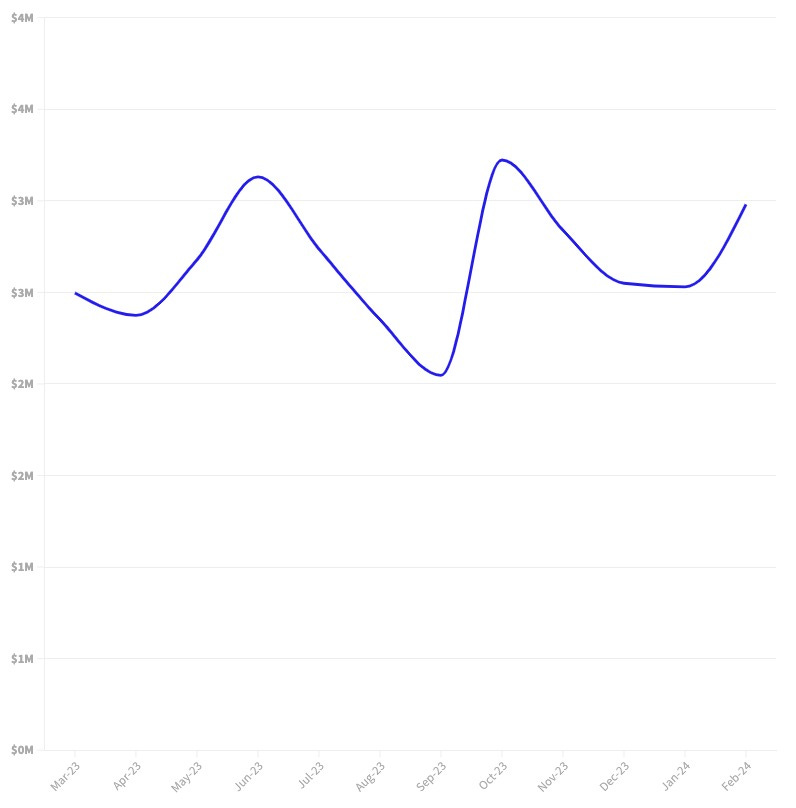

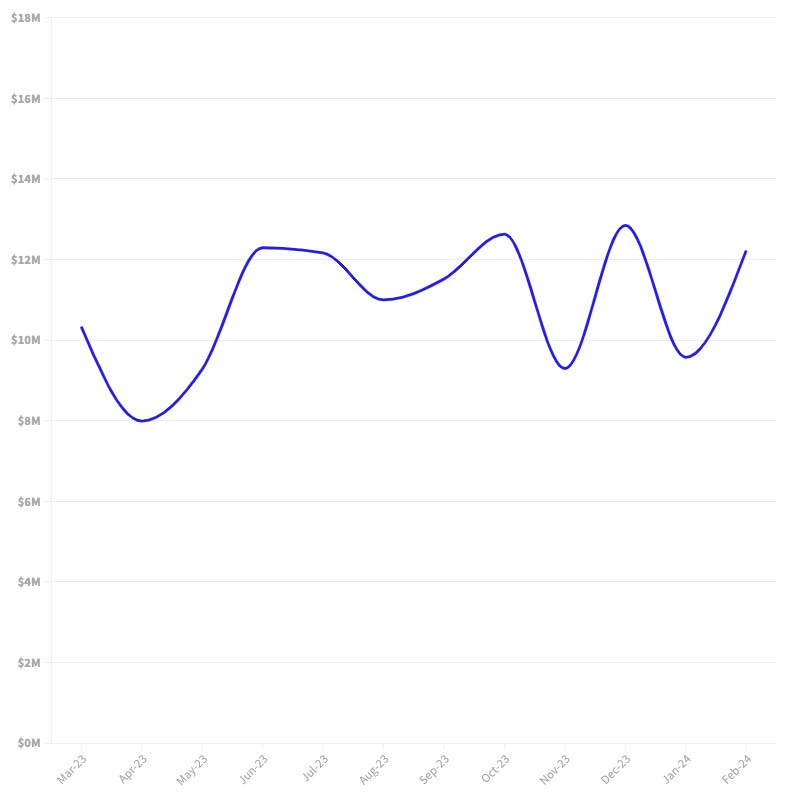

It’s the first Friday of the month, so that means it’s funding Friday. I hope you find the February startup funding data useful.

But before we get into the funding data…. here’s a helpful tip for all you startups that have a franchise tax bill from Delaware.

The Delaware Freakout

Every year at tax time, early stage startup founders across the country experience the “Delaware Freakout.” They open their Delaware Franchise Tax bill and are shocked to see a bill of $75,175 or some other equally ridiculous number. How could a tiny startup owe that much in taxes?

If this is you, don’t panic. The Delaware Freakout is a phenomenon where some startup founders or executives receive their first Delaware franchise tax bill and are taken aback by the amount they owe. This can be particularly surprising for companies that are pre-revenue or have only recently raised funding, as they may not have expected such a large expense. In some cases, the franchise tax bill can even exceed the company’s available cash balance.

This article will explain the Delaware Franchise Tax and how changing the method of calculation can save you $74,825. Westaway (3 minutes)

Funny and useful Franchise Tax Freakout tip for DIY startups, thanks. Re the funding info, my apologies, I forget the source of the data. Please remind me.