Founder Fridays No. 70

A Very Bad Year for Startup Funding.

Happy Friday!

A Very Bad Year for Startup Funding

There’s no two ways about it. This has been one of the worst years for startups in recent history.

The total amount of funding is way down. According to Pitchbook, it is likely that the total amount of venture funding invested in 2023 will be about $150 billion, marking the lowest total since 2015. By comparison that number was $354 billion in 2021 and $301 billion in 2022.

Down rounds have become more prevalent. Nearly 20% of all startups have raised money at a lower valuation than they had previously, according to Carta. That’s up from 5% in 2021.

Startup failure rate is high. More startups have shut down in the third quarter of 2023 since Carta began tracking the data almost five years ago. So far this year, 543 startups on Carta’s platform have shuttered.

Cautious Optimism for 2024

If you survived 2023, count yourself lucky and let’s hope for a better funding environment in 2024. Two points of optimism are that 1) The Fed seems to be indicating interest cuts in 2024 and 2) VC firms have a lot of capital that they need to deploy (so called “dry powder”). My hope is that these two forces will increase deal flow in 2024.

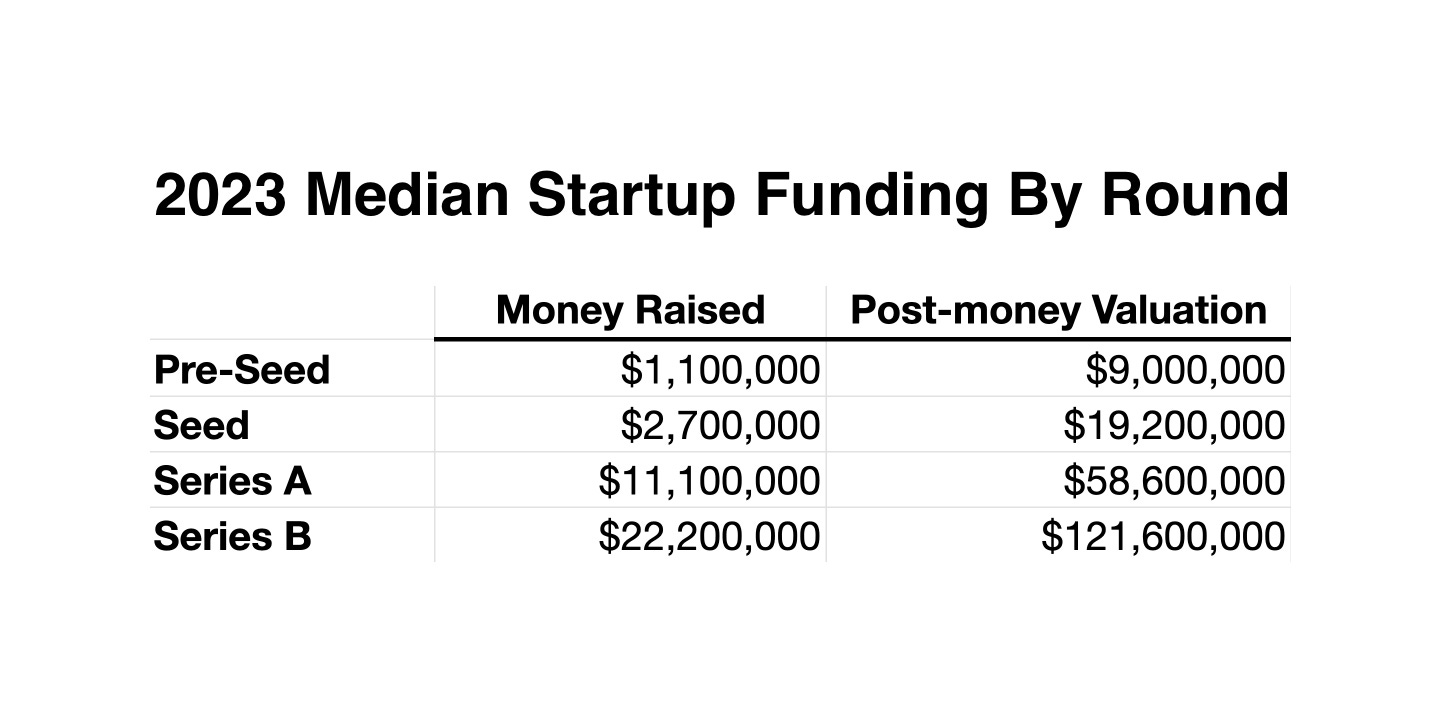

With that being said. See the chart below which is a summary of the median money raised and post-money valuation for each stage of funding in 2023. As always, we use AngelList’s data.

Founder FAQ: What is a down round?

A down round is a round of financing in which the company is valued lower than the previous round. Ideally, a startup will increase its valuation at every financing round. For example, normally a company might be valued at $50 million for its Series A, then $150 million for its Series B. If a company was valued at $50 million for its Series A, then $40 million for its Series B, that Series B is considered a down round. Down rounds are generally seen as a sign that the company is not doing well, so they should be avoided if possible. However, there are times when a down round is crucial for a startup to survive. Westaway (5 minutes)

Startup Funding Guides

I’ve put together a series of guides to equip founders to excel at fundraising. These guides break down the deal term by term and give you negotiation tips so that you can speak to investors with confidence.

Convertible Note: Guide / Video

Saving Time and Money on Legal in 2024

When we met this Series B startup, they frustrated with their law firm's slow turnaround and high fees. Contract reviews took 4-6 weeks and they charged $250,000 annually for basic work. The startup wanted to reduce sales cycle times and legal spend. They switched to General Counsel at Westaway. In year one,

We saved them about $200,000 in legal fees.

We shortened their sales cycle by about 4 weeks.

Our streamlined processes saved their ops team 8-10 hours per month previously spent managing legal.

By switching to Westaway, they expedited deal closures, saved hundreds of thousands in legal bills, and regained 1 day per month in productivity. If you’re curious if we could save you time and money in 2024, let’s talk.