Founder Fridays No. 27

Practical tips to help founders scale smartly.

Happy Friday!

As always, the first Friday of the month is focused exclusively on startup fundraising. However, today is special. In addition to the typical monthly startup funding data, I’m including data from AngelList and Silicon Valley Bank’s amazing report on startup funding in 2022.

There are so many good insights here. I hope it’s helpful for you. Shoot me a note or leave a comment to share your take on 2022 startup funding.

2022 State of Startup Funding

Our partners at AngelList worked with Silicon Valley Bank to create a very comprehensive report on the state of startup funding in 2022. Download the full report and watch the presentation here. The entire report is worth a read, but here are some takeaways:

Funding slowed way down. The year started our great for early stage startups, but the macroeconomic conditions started impacting funding in Q3 and Q4.Only 7.4% of startups raised capital in Q4 of 2022 making it the worst quarter for fundraising in recent years.

Down rounds abound. In Q4 of 2021 84% of startups raised at a higher valuation than their last round. In Q4 2022 that number dropped to 67%. So, 1/3 of venture deals in Q4 2022 were down rounds.

Valuations decreased at every stage of funding. In Q4 of 2022 pre-seed valuations declined by 3.9% from Q3. Seed declined by 13.9%. Series A declined by 9.6%. Series B declined by 20.8%.

SAFEs continue to dominate. In 2022 56% of the deals done on AngelList used SAFEs, that’s a 3% increase from 2021.

Startups are lowering their burn rate. It may not be a surprise to hear that startups are spending less to extend their runway. I was actually surprised at how small the changes have been though. According to Silicon Valley Bank in 2022 the median startup spend decreased only 2% between Q2 and Q3 and decreased by 1% between Q3 and Q4.

Revenue by sector

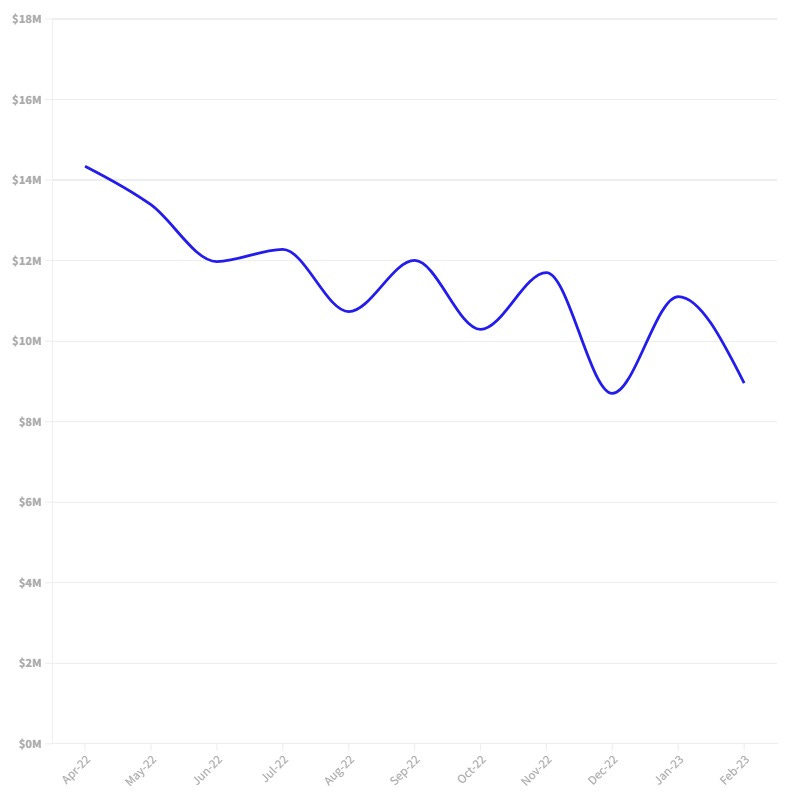

Spend by Sector

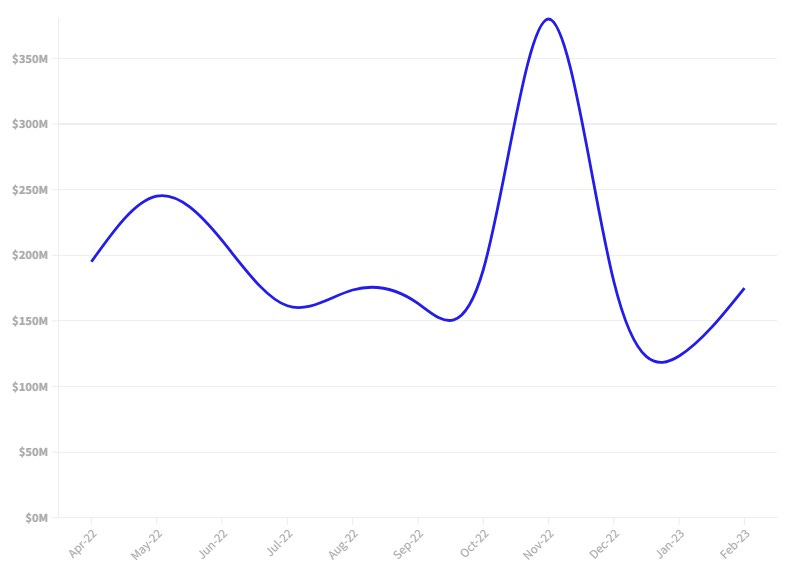

Funding by Sector

Now check out my typical month-to-month funding data below.

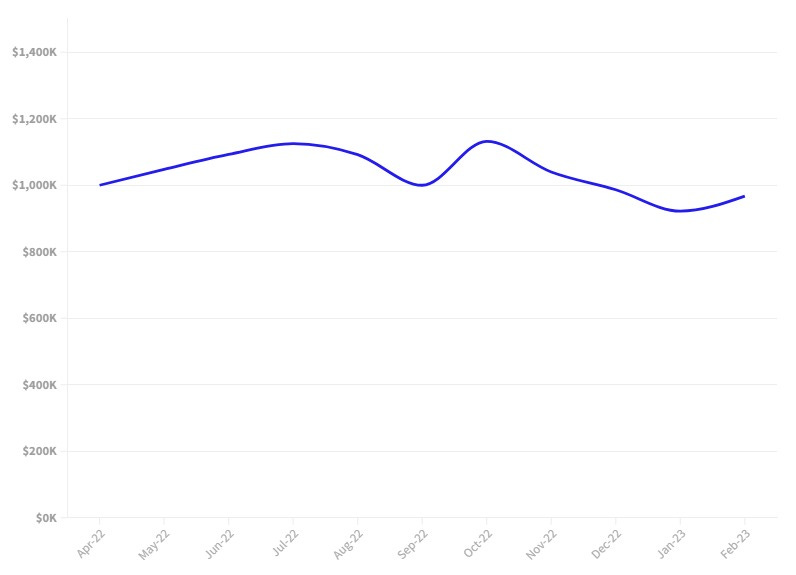

Pre-Seed

Median Money Raised:

$967,500

Median Post-Money Valuation:

$9,000,000

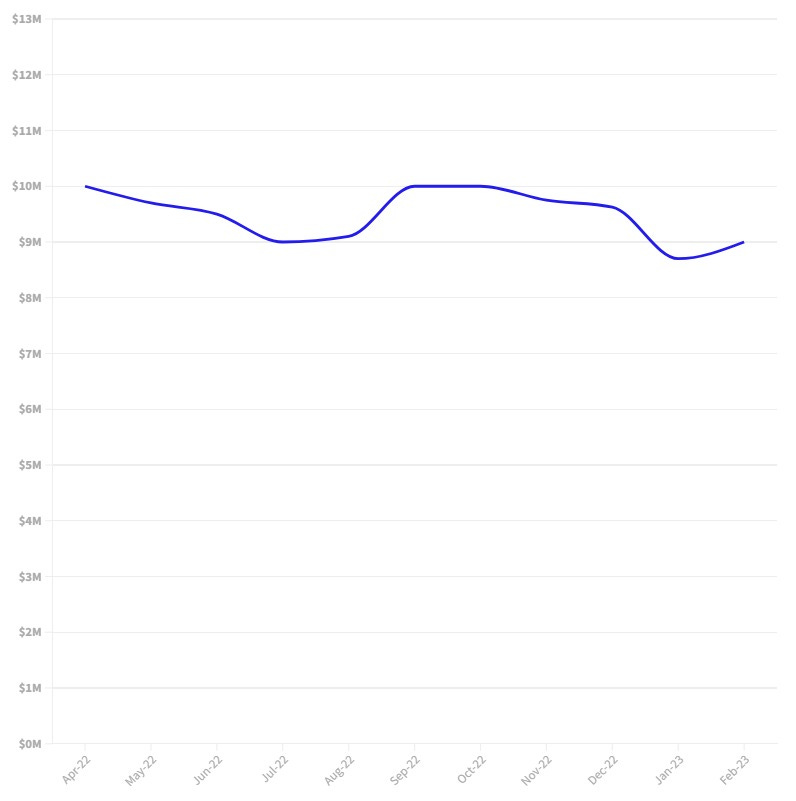

Seed

Median Money Raised:

$2,707,500

Median Post-Money Valuation:

$19,000,000

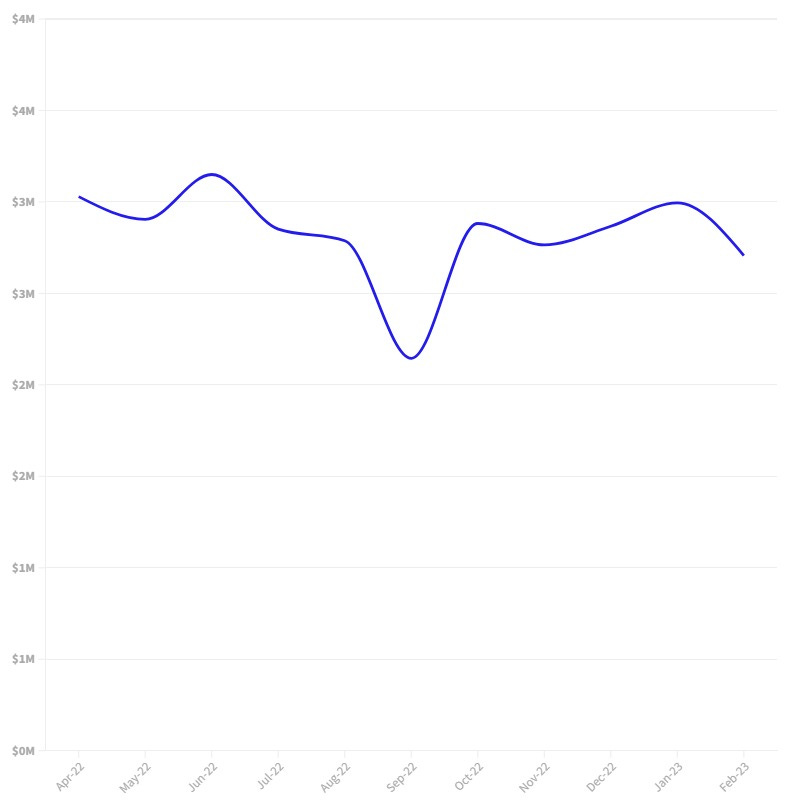

Series A

Median Money Raised:

$8,959,375

Median Post-Money Valuation:

$58,750,000

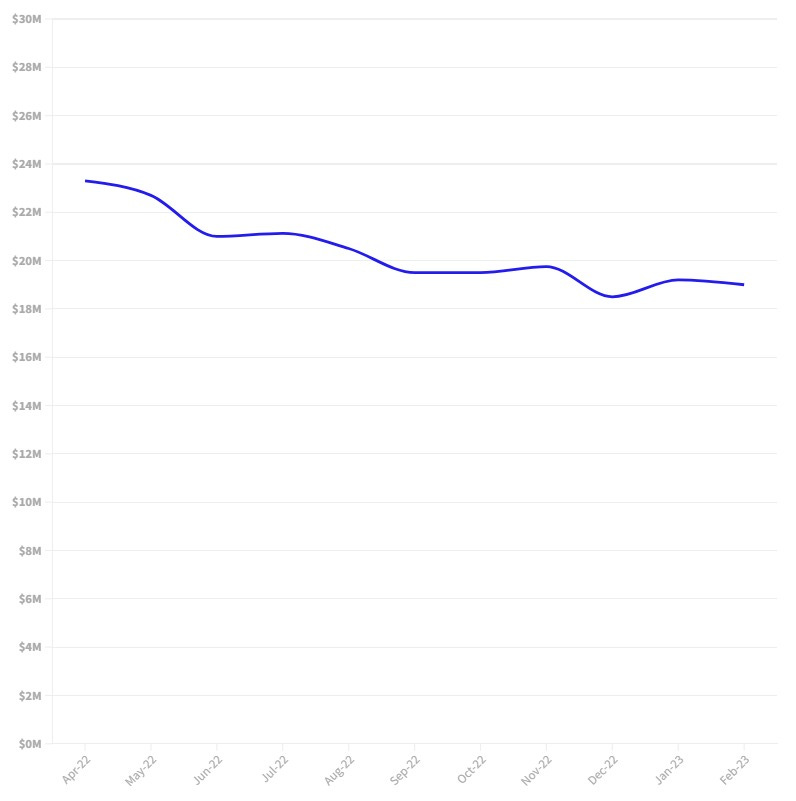

Series B

Median Money Raised:

$27,125,000

Median Post-Money Valuation:

$175,000,000

About Founder Fridays

Founder Fridays is a weekly briefing designed to help founders level up by learning best practices on startup funding, growth, product and management. After reading you will have industry context, think more clearly, make smarter decisions faster and spot new opportunities before anyone else. It is written by Kyle Westaway – Managing Partner of Westaway All funding data is from our partners at AngelList.

Startup Funding Guides

I’ve put together a series of guides to equip founders to excel at fundraising. These guides break down the deal term by term and give you negotiation tips so that you can speak to investors with confidence.

Should We Work Together?

This newsletter is my passion project. When I’m not writing, I run a law firm that helps startups move fast without breaking things. Most founders want a trusted legal partner, but they hate surprise legal bills. At Westaway, we take care of your startup’s legal needs for a flat, monthly fee so you can control your costs and focus on scaling your business. If you’re interested, let’s jump on a call to see if you’re a good fit for the firm. Click here to schedule a 1-on-1 call with me.