Founder Fridays No. 19

Practical tips to help founders scale smartly.

Happy New Year! Welcome to the new version of Founder Fridays.

My vision for this email has expanded and therefore the format has changed. I’m shifting this email from a monthly briefing focused exclusively on startup funding to a weekly email on startup funding, growth, product and management. The new goal of this briefing is:

Practical tips to help founders scale smartly.

To that end, every week I review the best ideas in the startup space and distill them into a short briefing that will help you level up by learning best practices. My hope is that after reading you will have more industry context, think more clearly, make smarter decisions faster and spot new opportunities before anyone else.

But, on the first Friday of each month (like today), you’ll still get a snapshot of the current state of startup funding for Pre-Seed, Seed, Series A and Series B.

This is still an experiment. If you have any suggestions on how to make Founder Fridays better, please reply to this email and let me know.

Lastly, we also created a fresh new brand identity for the newsletter. If you’re interested, you can read about it here.

Web3 Fundraising

My latest article in Forbes is about how to structure an early-stage Web3 fundraise. In 2017, there was a boom in initial coin offerings (ICO). These crypto projects would pre-sell a token, then promise to bring a product to market. Most of those projects were not able to deliver, and the value of the token dropped to zero. That same year, an estimated 80-90% of all ICOs failed, with only 8% of projects reaching a successful completion.

Web3 builders and investors have learned hard lessons from the ICO boom of the past. As a result, they are designing their projects differently now. Instead of just issuing a token, the modern Web3 project seeks to build and validate a product through the engagement of its community before releasing a token. This method of developing projects helps to ensure that the project is backed by a strong and engaged community, and that the token itself is likely to be more valuable and viable in the long term.

In many cases, Web3 companies are raising Pre-Seed, Seed or even Series A funding rounds before they issue a token. This leads to an important question: How should these early-stage funding deals be structured? Are they similar or different from a traditional startup funding round?

The short answer is that the best deal includes equity and gives investors a pro rata percentage of insider token allocation. Forbes (8 minutes)

Funding Prediction for 2023

Fred Wilson, Partner at Union Square Ventures believes startups are going to have a tough year in 2023. While many have gotten their burn rates way down, most startups still are losing money and will eventually need to raise capital in 2023. Because most startups avoided raising in 2022, there will be a glut of startup companies in the market for capital this year and while there is plenty of venture capital sitting on the sidelines waiting to be deployed, VCs will be much more selective, instead of funding everything that moves as we’ve done over the last few years. Good businesses with product market fit, positive unit economics, and strong leadership teams will raise capital although it will be at the new normal in terms of valuation. I believe that “new normal” is more or less where we were in 2015 where seed rounds were done around $10mm, A rounds were done around $15mm to $25mm, B rounds were done around $25mm to $50mm, and growth rounds had a cap at 10x revenues. AVC (6 minutes)

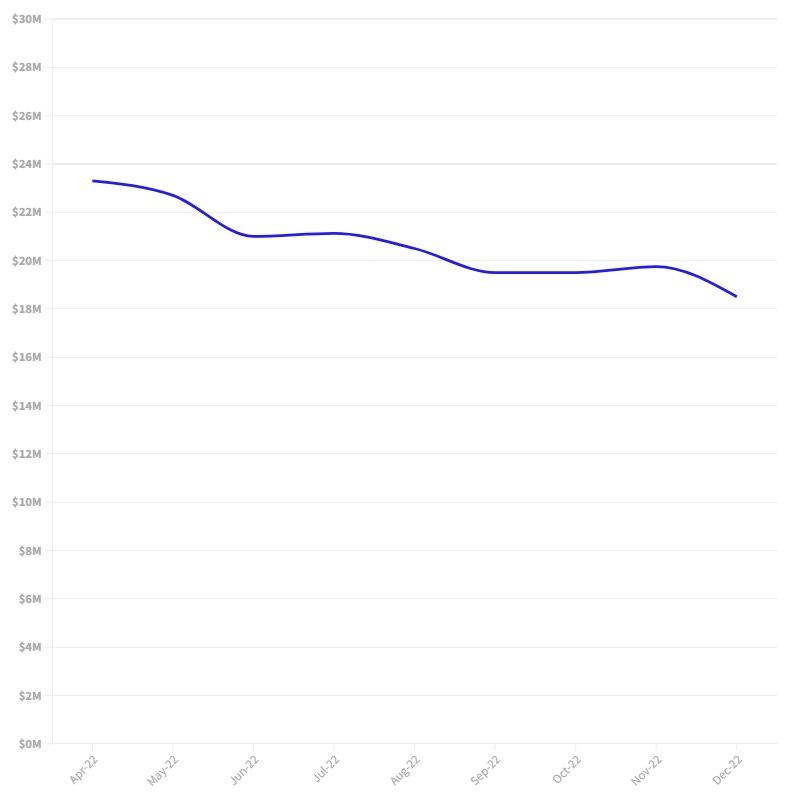

Pre-Seed

Median Money Raised:

$986,562

Median Post-Money Valuation:

$9,625,000

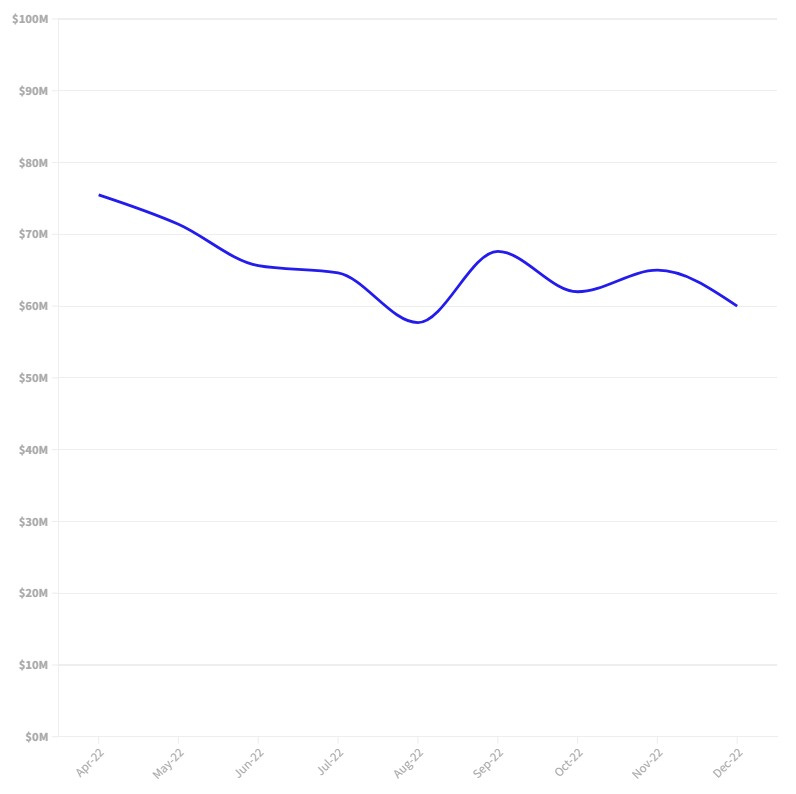

Seed

Median Money Raised:

$2,867,500

Median Post-Money Valuation:

$18,500,000

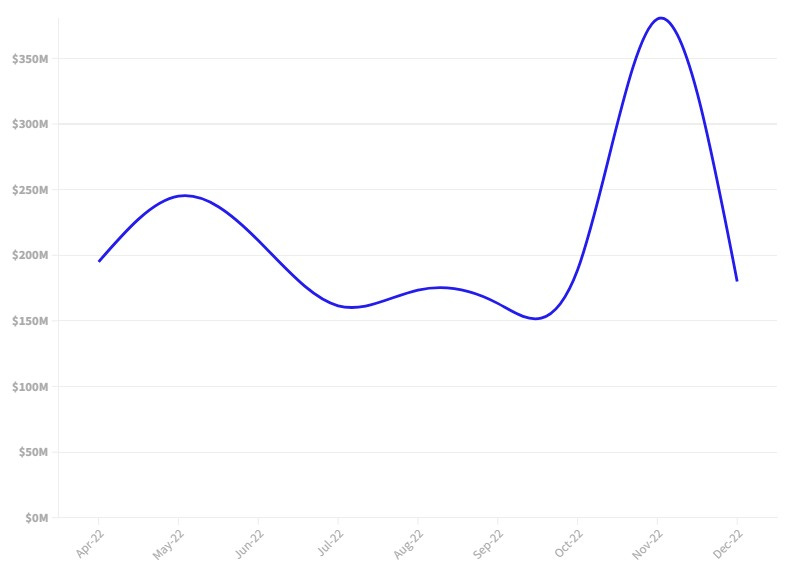

Series A

Median Money Raised:

$8,700,000

Median Post-Money Valuation:

$60,000,000

Series B

Median Money Raised:

$27,000,000

Median Post-Money Valuation:

$180,000,000

About Founder Fridays

Founder Fridays is a weekly briefing designed to help founders level up by learning best practices on startup funding, growth, product and management. After reading you will have industry context, think more clearly, make smarter decisions faster and spot new opportunities before anyone else. It is written by Kyle Westaway – Managing Partner of Westaway All funding data is from our partners at AngelList.

Startup Funding Guides

I’ve put together a series of guides to equip founders to excel at fundraising. These guides break down the deal term by term and give you negotiation tips so that you can speak to investors with confidence.

Should We Work Together?

This newsletter is my passion project. When I’m not writing, I run a law firm that helps startups move fast without breaking things. Most founders want a trusted legal partner, but they hate surprise legal bills. At Westaway, we take care of your startup’s legal needs for a flat, monthly fee so you can control your costs and focus on scaling your business. If you’re interested, let’s jump on a call to see if you’re a good fit for the firm. Click here to schedule a 1-on-1 call with me.