Founder Fridays No. 18

A briefing on startup funding sent out on the first Friday of the month.

Happy Friday!

Pitchbook just released some data on Q3 fundraising. The main headline is that Web3 funding is strong. My sense from the Web3 deals I’ve been working on, is that the FTX scandal has slowed Web3 funding way down in Q4. Here are some key takeaways: (1) Tech investment fell for the third consecutive quarter, down 52% from Q4 2021’s record of $9.8 billion across 275 deals. However, the median size for early-stage deals reversed course in Q3, hitting an all-time peak of about $28 million. (2) Web3 & DeFi topped the charts yet again, notching $879 million. Fintech and biotech followed close behind, while segments like insurtech and mobility gained little traction. (3) The number of venture mega-deals is creeping back up to normal, with 10 ETI deals of $100 million or more recorded in Q3, including a $350 million deal for Adam Neumann’s new company, Flow. Pitchbook (16 minutes)

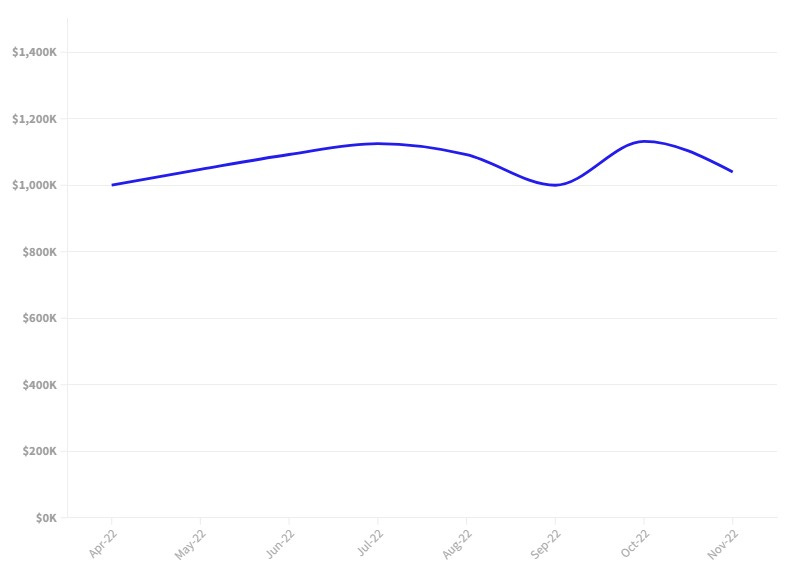

Pre-Seed

Median Money Raised:

$1,040,000

Median Post-Money Valuation:

$9,750,000

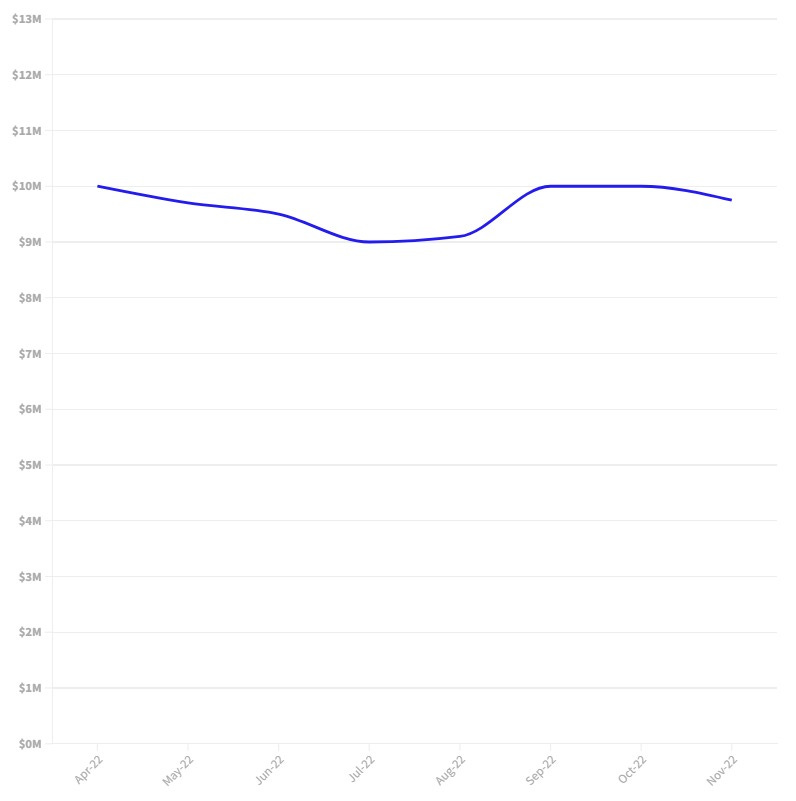

Seed

Median Money Raised:

$2,765,000

Median Post-Money Valuation:

$19,750,000

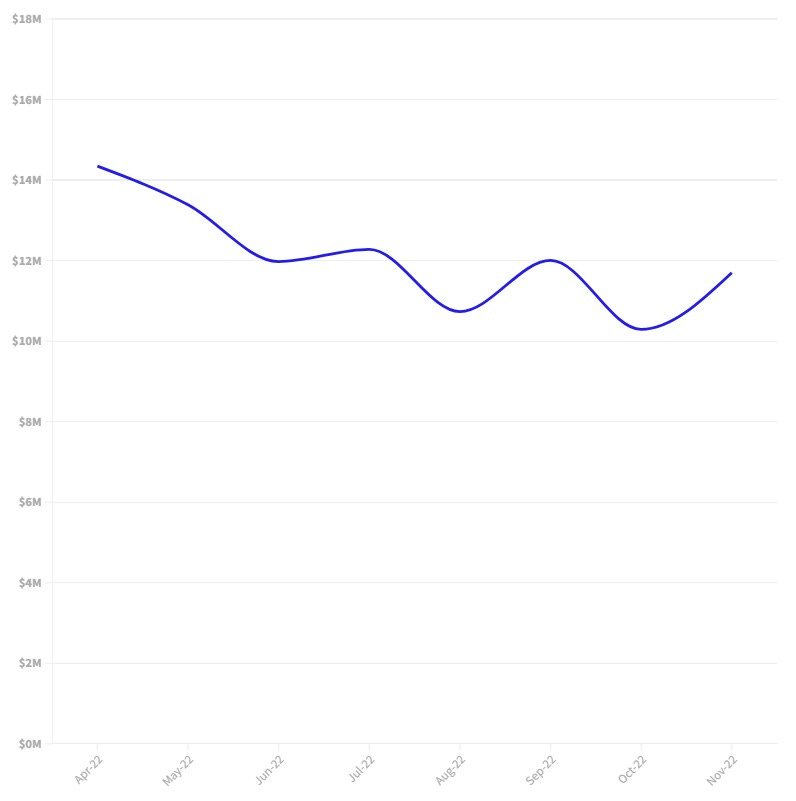

Series A

Median Money Raised:

$11,700,000

Median Post-Money Valuation:

$65,000,000

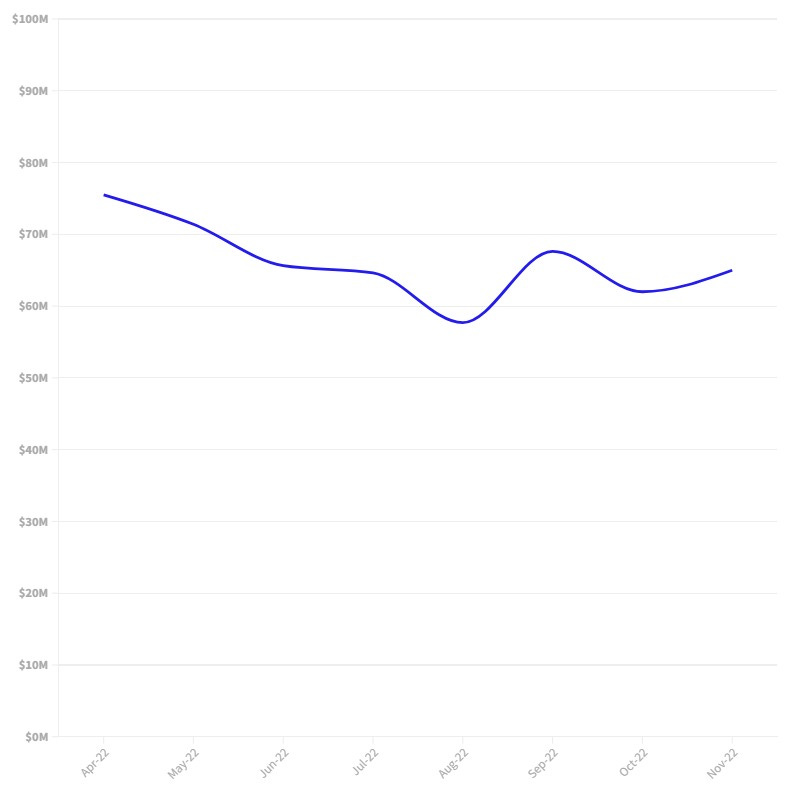

Series B

Median Money Raised:

$64,600,000

Median Post-Money Valuation:

$380,000,000

Series C

Median Money Raised:

$29,400,000

Median Post-Money Valuation:

$210,000,000

About Funding Fridays

Funding Fridays is a briefing on startup funding written by Kyle Westaway – Managing Partner of Westaway and powered by data from AngelList.

Curious, is Series B and Series C data flipped?