Founder Fridays No. 164

Digital Communities Need Physical Form -- Costco’s Radical Simplicity -- AI Killed Inbound Marketing

Happy Friday.

Digital Communities Need Physical Form

The Internet isn’t just a communication medium—it’s becoming a jurisdiction with its own code-based legal system managing 99% of global transactions, and now it needs territory. Popups are temporary physical manifestations where online communities meet in real space (think Cursor Cafe, Zuzalu, Coinbase’s Basecamp), essentially prototypes that can scale into permanents like SpaceX’s Starbase or Solana’s Economic Zone in Kazakhstan. This represents the third evolution after internet companies and cryptocurrencies: internet communities that can negotiate diplomatic recognition and own real estate, transforming from digital networks into physical nation-states. The playbook mirrors SaaS deployment—start by leasing (popup), prove product-market fit, then buy infrastructure and scale (permanent). Balaji’s (6 minutes)

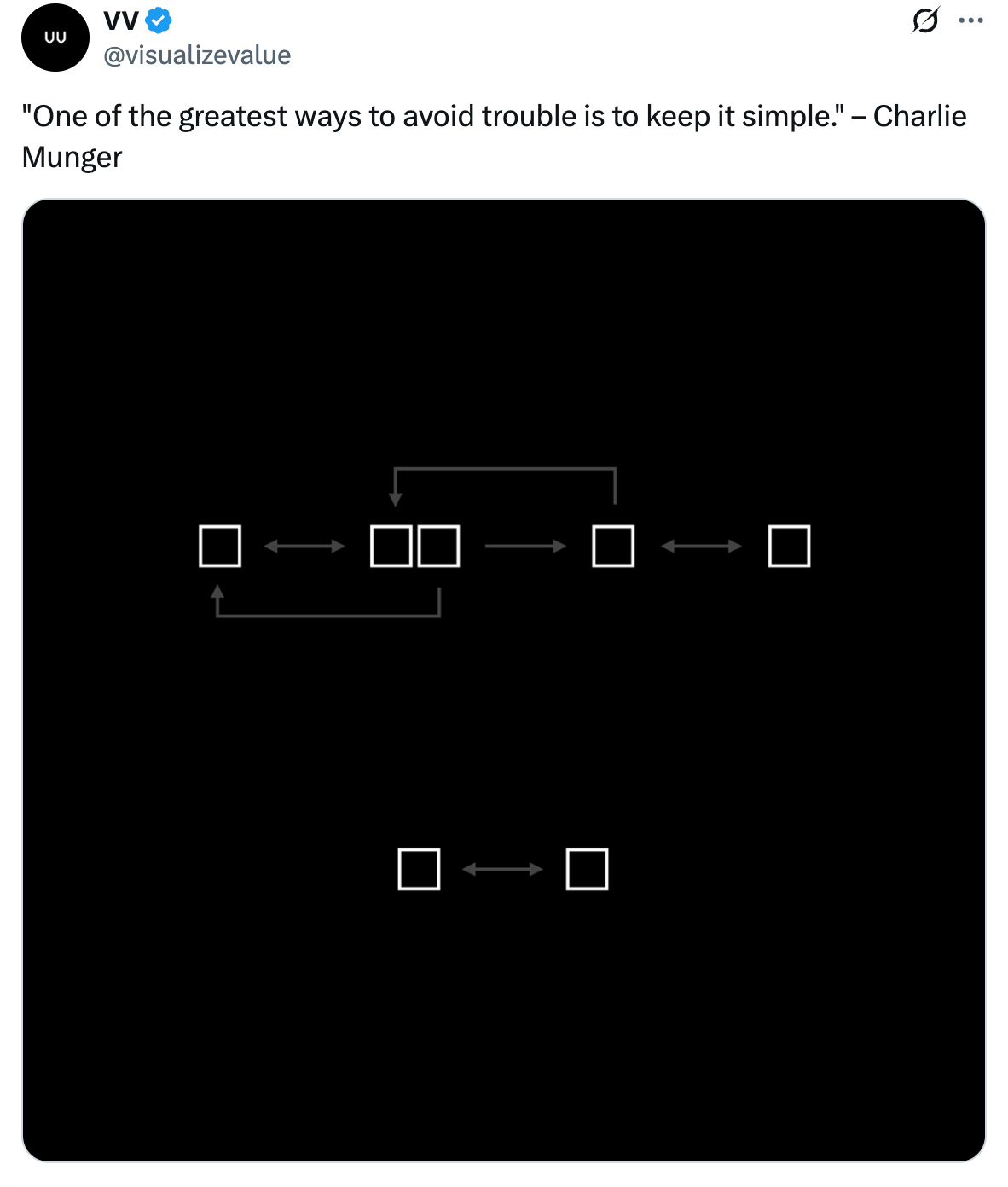

Costco’s Radical Simplicity

What if the secret to building a $230 billion empire is refusing to squeeze extra profit from a bottle of ketchup? Costco caps markups at 14% and hasn’t raised its hot dog price in 47 years, deliberately passing 89% of supplier savings to members instead of shareholders—a strategy so counterintuitive that CEO Jim Sinegal compared price increases to heroin addiction. The warehouse giant maintains just 3,800 products versus Walmart’s 100,000, accepts “intelligent loss of sales” by refusing to stock every size, and even owns chicken processing plants to keep rotisserie prices low. This obsessive focus on member value over short-term profits has created an unbreakable flywheel: massive volume drives supplier discounts, which drive lower prices, which drive loyalty (93% renewal rate), which drives more volume—making Costco’s model nearly impossible for competitors to replicate. Acquired Briefing (14 minutes)

AI Killed Inbound Marketing

The old B2B playbook—SEO, inbound leads, channel specialists—is dying because AI didn’t just speed things up, it created cascading ripple effects that broke the entire system. ChatGPT replaced Google searches (killing web traffic), democratized content creation (flooding audiences with sameness), and made ICP data universally accessible (saturating outbound channels), which means your carefully optimized website might never get visited and your “personalized” emails are drowning in noise. The new playbook requires four shifts: 1) stand out with authentic content only you can make, 2) build proactive account-driven GTM across all teams, 3) run fewer but bigger cross-channel campaigns, 4) and hire AI-powered generalists who can orchestrate fuel and engine together. Inbound isn’t dead yet, but it’s now just one signal in a proactive strategy—not the strategy itself. MKT1 (12 minutes)

Founder FAQ: Why should IPs be owned by the companies?

The creator owns the IP by default—not the company—which means without proper assignment agreements, your startup’s most valuable assets could walk out the door with a departing founder or employee. Investors won’t touch companies with ambiguous IP ownership because without those rights, most startups have zero value; the core asset isn’t the product or code itself, but the legal ownership of it. Confidential Information and Invention Assignment Agreements (CIIAAs) transfer IP rights from individuals to the company, protecting continuity, enabling licensing and monetization, and preventing costly ownership disputes that can kill fundraising or M&A deals. Get every founder, employee, contractor, and advisor to sign assignment agreements immediately—this isn’t negotiable paperwork, it’s the foundation of your entire valuation. Westaway (4 minutes)

Startup Funding Guides

I’ve put together a series of guides to equip founders to excel at fundraising. These guides break down the deal term-by-term and give you negotiation tips so that you can speak to investors with confidence.

Convertible Note: Guide / Video

Control Legal Spend

Startups suffer from unpredictable legal bills under the billable hour system. Fees fluctuate month to month without warning. Law firms drag out billable hours, but startups foot the bill. Even basic work can lead to surprisingly high legal bills. This unpredictability cripples financial planning. Budgets rarely match actual spend. With utter uncertainty around legal spend, startups cannot forecast or manage burn rates effectively. The antiquated billable hour system fails them. Our General Counsel flat, monthly fee service gives startups cost certainty. Legal spend becomes predictable with bundled services and no surprise overage bills. By switching from hourly to our flat-fee model, startups finally get confident budgeting, accurate forecasting and predictable legal spend. If you’re sick of getting surprise legal bills and are interested in controlling your legal spend, let’s talk.