Founder Fridays No. 150

Silicon Valley's Equity Secret -- Crypto-AI Convergence Roadmap -- NVIDIA’s $4T Market Cap

Happy Friday.

Here’s my July playlist. Enjoy!

Silicon Valley's Equity Secret

The "Traitorous Eight" engineers who founded Fairchild Semiconductor in 1957 didn't just invent the computer chip. They accidentally created the blueprint for Silicon Valley wealth by demanding equity ownership in their startup. When Sherman Fairchild bought them out for $3 million, each engineer walked away with $300,000 and a crucial lesson: ownership matters more than salary. This sparked a revolution where tech employees earned stock options, creating 300 millionaires at Apple's IPO, 3,000 at Microsoft's and turning average Google employees into multimillionaires. While this employee equity model reduced inequality compared to traditional corporate ownership, it still concentrated wealth at the top — but research shows that expanding worker ownership to 30% across all businesses could double median household wealth and nearly eliminate income inequality. The Elysian (7 minutes)

Crypto-AI Convergence Roadmap

The collision between artificial intelligence and cryptocurrency is creating entirely new economic models that could reshape how we interact with technology and own digital assets. Investment firm a16z has identified 11 key crossovers at this intersection. Here are the five most compelling: 1) Persistent AI context that travels with users across platforms as blockchain-stored digital assets, allowing your AI assistant to remember your preferences whether you're using ChatGPT or Claude. 2) Universal identity passports for AI agents would enable them to accept payments, verify capabilities and build reputation across multiple platforms without being locked into any single ecosystem. 3) Micropayment systems could automatically compensate content creators when AI tools reference their work, potentially solving the economic crisis facing publishers and educators whose content trains AI models. 4) Decentralized physical infrastructure networks could democratize AI by pooling unused computing power from gaming PCs and data centers, breaking the stranglehold of big tech on AI development. 5) Blockchain-based AI companions would be owned and controlled by users rather than companies, ensuring your digital relationships remain private and uncensorable. As AI reshapes the internet from an open web into a prompt bar, cryptocurrency offers the infrastructure to keep that future decentralized rather than controlled by a handful of tech giants. A16z (12 minutes)

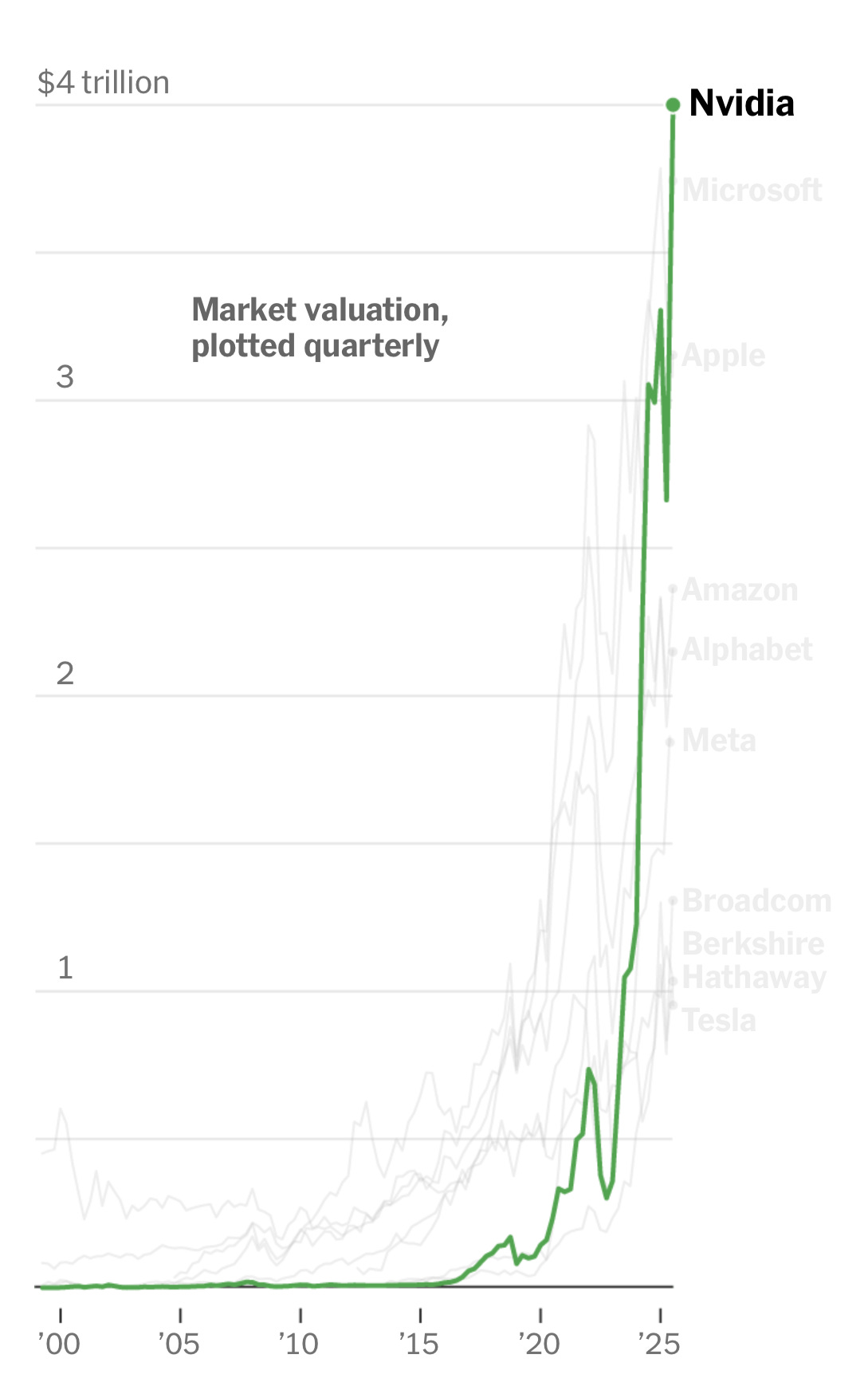

NVIDIA’s AI Goldmine

NVIDIA survived a $500 billion market cap wipeout in 2022 only to become the world's most valuable company within 18 months, riding the generative AI wave that nobody saw coming. As you can see from the chart, yesterday NVIDIA was the first company to hit $4T in maket cap. That’s trillion with a T. The chip company's secret weapon wasn't just powerful GPUs. It was CUDA, a software platform launched in 2006 that now locks in 4 million developers who can't easily switch to competitors. When ChatGPT exploded in November 2022, NVIDIA was perfectly positioned with its H100 chips and data center infrastructure, generating $10.3 billion in data center revenue by 2023 — a segment that barely existed five years earlier. The company's moat runs deeper than hardware: competitors would need to replicate not just NVIDIA's chips but also its networking technology, manufacturing capacity at TSMC and, most importantly, its massive developer ecosystem that took over a decade to build. Acquired Briefing (8 minutes)

Founder FAQ: What Are the Best Practices for Startup Advisors?

Finding the right startup advisor can make or break your early-stage company, but most founders approach this relationship without a clear strategy or legal framework. Effective advisors should possess proven experience in your industry, deep networks for introductions and the intellectual honesty to tell you hard truths even when you don't want to hear them — qualities that separate valuable mentors from well-meaning but ineffective helpers. The key is matching advisor types to your specific needs: serial entrepreneurs for operational guidance, industry experts for market insights or technical specialists for product development challenges. Most advisors receive 0.1% to 0.5% equity with vesting schedules. Their real value comes from their ability to open doors, provide strategic counsel and help you avoid costly mistakes that could sink your startup. Westaway (7 minutes)

Startup Funding Guides

I’ve put together a series of guides to equip founders to excel at fundraising. These guides break down the deal term-by-term and give you negotiation tips so that you can speak to investors with confidence.

Convertible Note: Guide / Video

An Innovative Law Firm?

Being listed among Fast Company's “Most Innovative Companies” is an honor for our law firm, yet we believe innovation matters if it actually produces better outcomes for startups. Here’s how we’ve innovated to better serve startups:

Clear Pricing. Traditional billable hours can lead to misaligned objectives and unexpected fees. We've replaced this with straightforward, flat-rate pricing.

General Counsel. Most entrepreneurs want a trusted legal partner, but they hate surprise legal bills. At Westaway, we take care of your startup’s legal needs for a fixed, monthly fee so you can control your costs and focus on scaling your business.

Automation and Artificial Intelligence. We've streamlined our operations through automation and AI (where appropriate), ensuring efficient, high-caliber results.

If you’re an innovative startup looking for an innovative law firm, let’s talk.