Founder Fridays No. 145

May Funding Data

Happy Friday!

Welcome to the month of June.

Check out the the May venture capital funding data from AngelList.

But before we jump in, I’ve got something exciting to announce…

Introducing the Acquired Briefing

If you're familiar with the Acquired podcast, you know why it's captivating. For those who aren't, Acquired tells the stories and strategies behind great companies, hosted by Ben Gilbert and David Rosenthal. It's the #1 Technology show on both Apple Podcasts and Spotify, reaching over one million listeners per episode. The Wall Street Journal calls it "the business world's favorite podcast."

These aren't typical podcast episodes—they're better described as "conversational audiobooks" that prioritize depth over brevity. Recent guests have included the founders and CEOs of NVIDIA, Berkshire Hathaway, Starbucks, Meta, Spotify, TSMC, and CAA.

The Challenge

Every Acquired episode is packed with brilliant business insights. While I love the audio format, I face a constant challenge: I'm usually listening while running, doing dishes, or commuting. I find myself pausing repeatedly to jot down key insights on my phone. Since there are no written episode summaries available online, I started creating my own detailed briefings after each listen.

The Solution

I realized other fans might want a written reference to review and reinforce their learning. That's why I'm launching the Acquired Briefing—a newsletter that distills each episode's key insights into an accessible, searchable format.

Here's what to expect:

Fresh episodes: Briefings released shortly after new episodes drop

Back catalog series: One briefing every Thursday morning covering their greatest hits

Starting strong: A series of 11 standout episodes, beginning with their most popular

What better way to kick things off than with their Taylor Swift episode? Click below to read the fascinating story of the business side of T-Swift’s empire and subscribe to get future Acquired Briefings.

Thanks for reading.

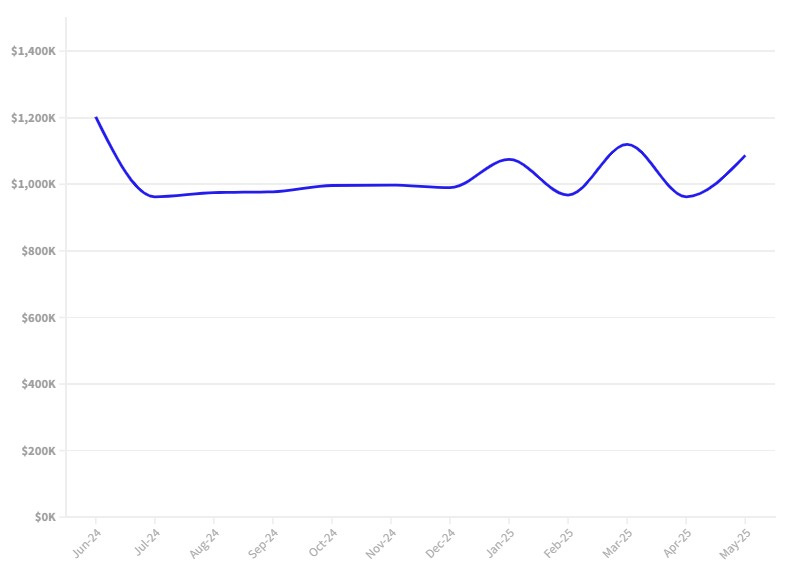

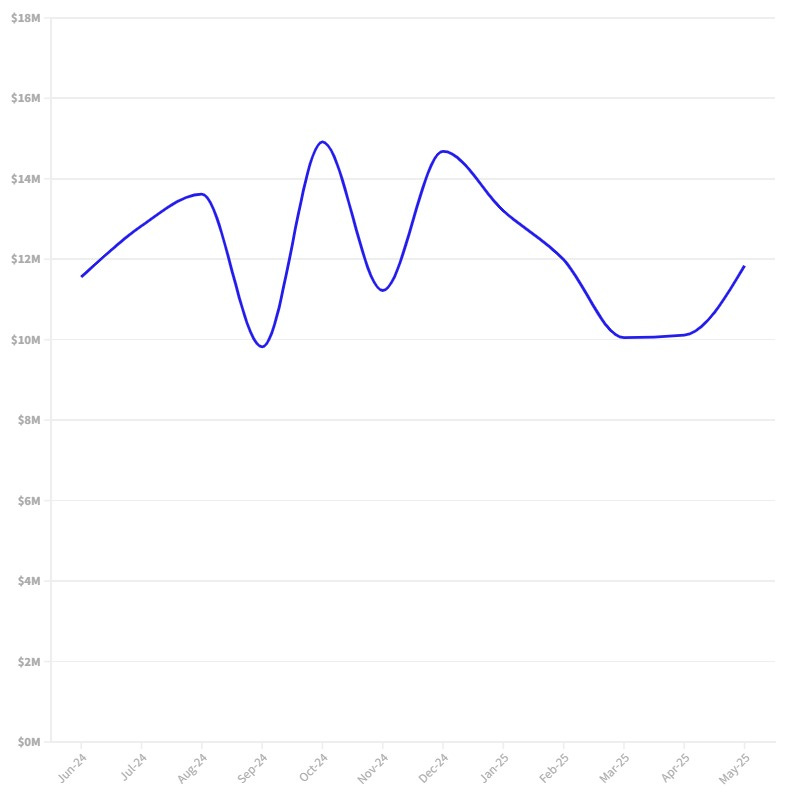

Pre-Seed

Median Money Raised:

$1,086,875

Median Post-Money Valuation:

$9,250,000

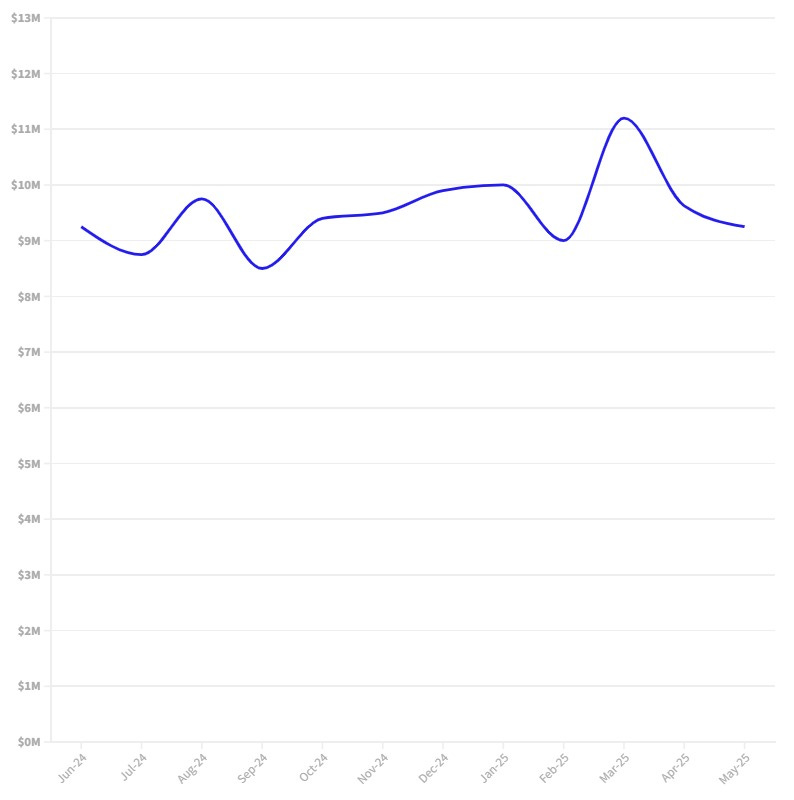

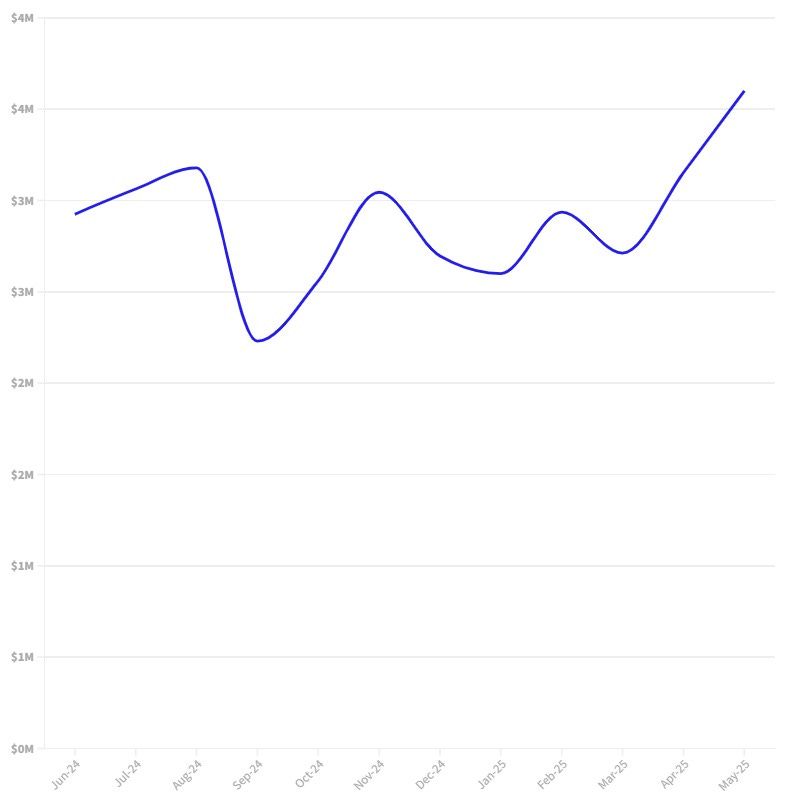

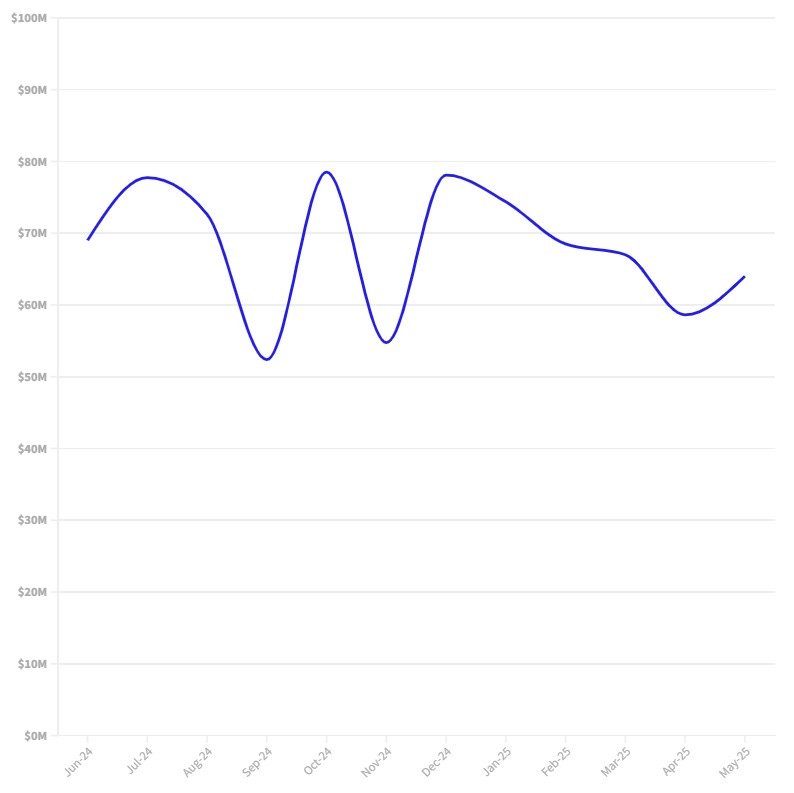

Seed

Median Money Raised:

$3,600,000

Median Post-Money Valuation:

$22,500,000

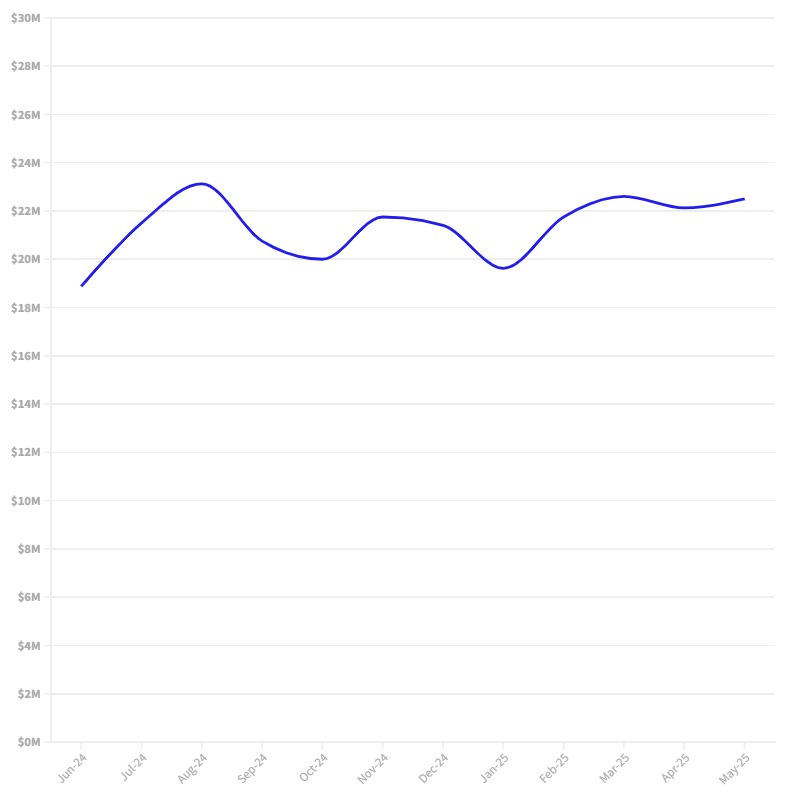

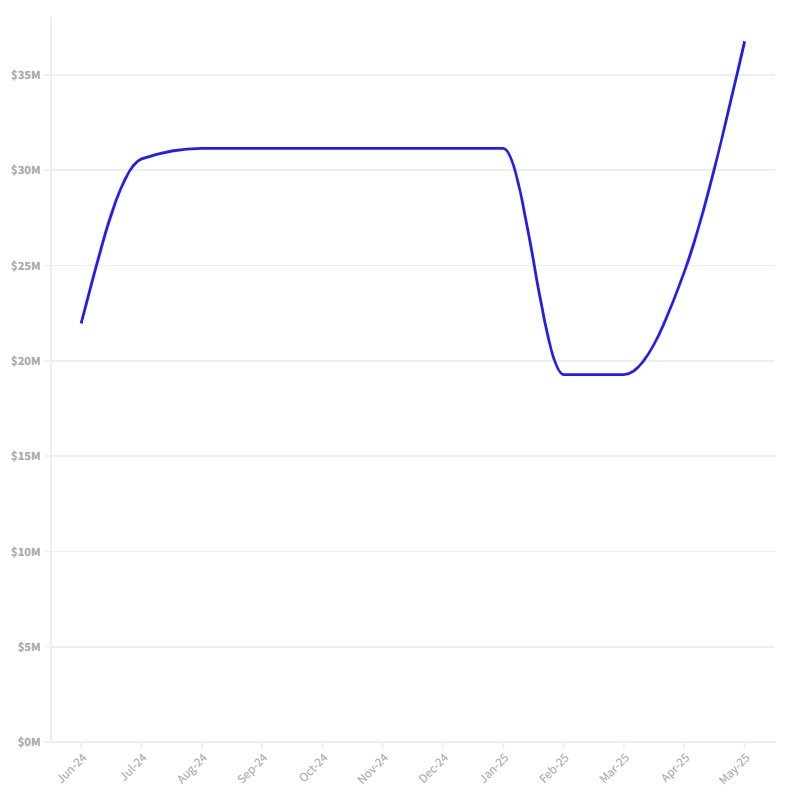

Series A

Median Money Raised:

$11,840,000

Median Post-Money Valuation:

$64,000,000

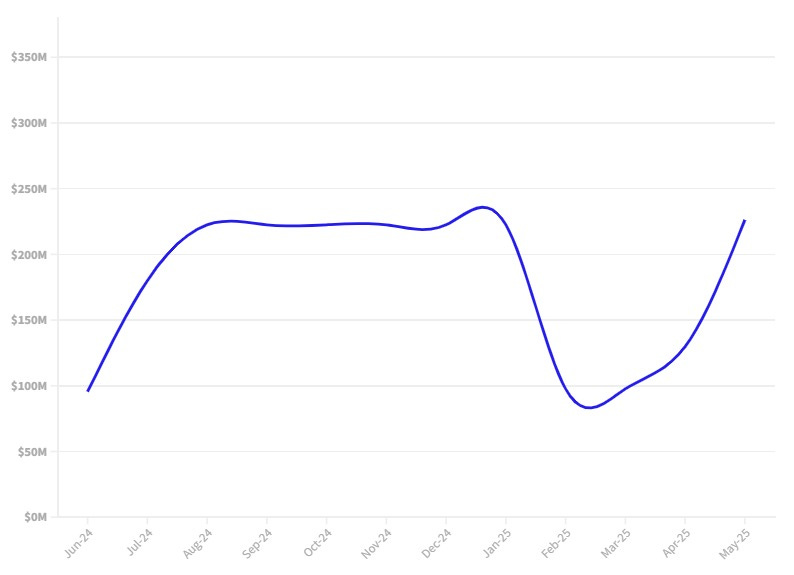

Series B

Median Money Raised:

$36,765,625

Median Post-Money Valuation:

$226,250,000

Startup Funding Guides

I’ve put together a series of guides to equip founders to excel at fundraising. These guides break down the deal term by term and give you negotiation tips so that you can speak to investors with confidence.

Convertible Note: Guide / Video

Should a Seed Round Cost $100,000 in Legal Fees?

A friend recently told me his relatively straightforward $7 million seed round costs over $100,000 in legal fees — much higher than initially quoted. Unfortunately, this is becoming more common. However, for an experienced startup law firm, a standard seed round based on NVCA docs should cost $25,000 to $50,000 all in. At my firm Westaway, this complete seed round package is a flat $30,000. (It’s also included in our General Counsel — Grow plan.) No runaway legal costs. No surprise bills. Just transparent pricing. If you’ve got an upcoming fundraise, let’s talk.